-

Responsibility

- Responsible investing

Responsible investing

Responsible investing refers to investment activities that take into consideration the environment, society and good governance. Responsibility influences the long-term potential for a company’s success and taking this into consideration in investments also produces results for the investor.

Net zero asset manager by 2050

Evli's climate targets aim to make a real impact on investments, businesses and the industry.

Responsible Investing at Evli

We want to grow our clients’ wealth in a responsible manner. For this reason, responsibility is integrated into Evli’s Wealth Management investment operations and our funds are managed in accordance with Evli's Principles for Responsible Investment.

-

1. Principles for Responsible Investment

- Policies by asset classes

- Separate Climate Change Principles and engagement policy

- Climate Target and Biodiversity Roadmap for taking biodiversity into account

- Internal division of responsibilities and governance model

2. ESG -integration in investment process

- Responsibility analysis as part of the investment decision-making

- Asset class-specific responsibility expertise

- Responsible investment team as support for portfolio managers

3. Engagement and active ownership

- Independent discussions with companies

- Collaborative engagement and investor initiatives

- Asset class-specific engagement and active ownership

4. Reporting

- Comprehensive and transparent reporting at fund and client level

- Responsible Investment Annual Review overviews annually progress in responsible investing

-

Climate change is one of the biggest threats of our time, and we want to play our part in mitigating it through responsible investment. All of Evli's investments follow the company's Climate Change Principles.

Read more from Evli's Wealth Management's Climate and Nature Principles

Evli's own climate risk reporting

The TCFD (Task Force on Climate-related Financial Disclosures) is an international climate risk reporting framework that looks at climate change threats and opportunities for companies. We report on Evli's climate risks in accordance with TCFD guidelines. The first report was published within the 2019 Corporate Responsibility Report. In August 2019, we joined the TCFD as a public supporter.

-

Incorporating biodiversity, or in other words natural diversity, into investing is fast emerging as a significant area of responsibility alongside climate change. Evli has prepared its biodiversity roadmap with action steps for 2023–2025. The objective of the roadmap is to gain a better understanding of biodiversity-related risks and impacts of investments on biodiversity.

Read more about Evli Wealth Management’s biodiversity roadmap

Evli’s biodiversity reporting

Task Force on Nature-related Financial Disclosures (TNFD) is a market-led, science-based initiative that has developed a reporting framework on nature for financial institutions and organisations. Evli was the first Finnish asset manager to join the TNFD forum in 2022 and will according to Evli’s biodiversity roadmap report according to TNFD recommendations in 2025 based on the year 2024.

-

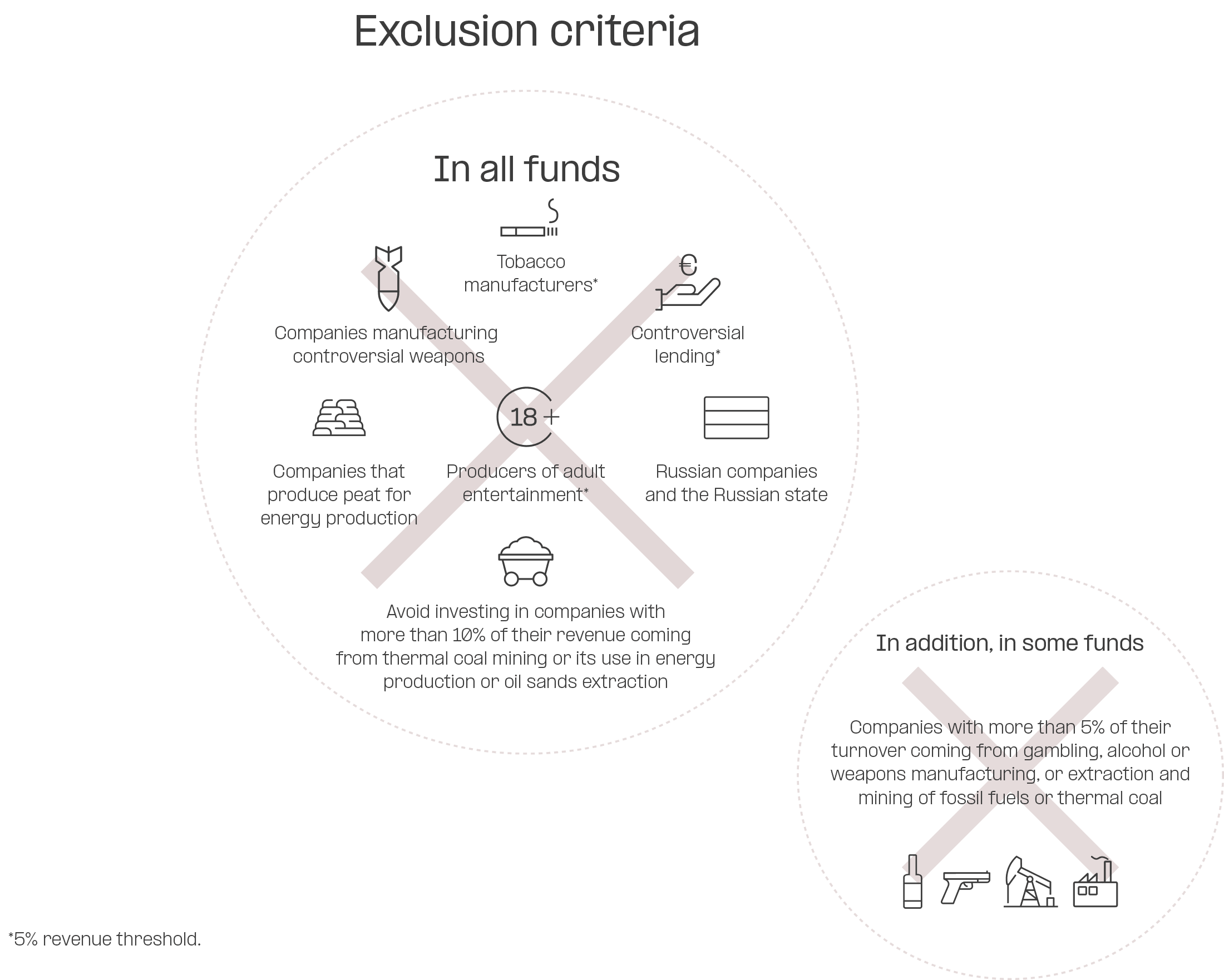

Exclusion is one of the most concrete ways to implement the Principles for Responsible Investment. At Evli, exclusion is a two-stage process: certain principles apply to all Evli’s active equity and fixed income funds and investments, in addition to which some funds comply with broader exclusion criteria.

-

Evli Plc’s (Evli) Responsible Investment Executive Group approved the following principles regarding the addressing of sustainability risks and adverse sustainability impacts. Sustainability risk refers to an environmental, social or governance event or condition that, if it occurred, could cause an actual or potential material negative impact on the value of an investment. These principles regarding the addressing of sustainability risks and adverse sustainability impacts will be applied whenever Evli Plc invests client assets under its asset management in, and/or whenever it offers investment advice to, the funds managed by Evli Fund Management Company Ltd and the assets under its asset management. Therefore, the same principles will be applied throughout the Evli Group, and the word “Evli” below will refer to all Evli Group companies.

According to the regulation, Evli identifies and takes into account the client's possible preferences related to the sustainability of investments when offering the client discretionary asset management service and investment advice.

Evli takes account of the sustainability risks in its investments and of the principal impacts of its investments on sustainability factors in accordance with Evli’s Principles for Responsible Investment. Adverse impacts on sustainability factors are taken into account in Evli’s asset management and funds through an internal process based on Evli’s Principles for Responsible Investment and Climate and Nature Principles in a way that does not conflict with the client’s own policies or investment preferences. Evli’s Principles for Responsible Investment are asset class-specific and cover all the active investments under Evli’s management. Fund-specific or asset class-specific principles may vary on how sustainability risks and adverse impacts of investments on sustainability factors are considered. In addition, there can be funds or individual products that do not consider the principal adverse sustainability impacts.

Evli’s Principles for Responsible Investment cover:

- Evli Wealth Management Principles for Responsible Investment

- Evli's Wealth Management Climate and Nature Principles

- Evli’s Climate Targets

- Evli's ownership control principles

- Evli Fund Management ownership principles

- Evli’s principles for responsible investment for direct private equity investments and funds

- Alternative Investment Fund-of-Funds' and Co-Investment funds' principles for responsible investment

- Principles for responsible investment for real estate funds

- Evli Asset Management - The implementation of engagement policy

The above-mentioned principles describe how Evli identifies and analyzes sustainability impacts and the related indicators and what Evli’s procedures are with respect to these. One example of a negative sustainability impact is a breach of a norm, i.e. an act that breaches the principles of the UN Global Compact corporate responsibility initiative, for which Evli has specified a systematic procedure. We monitor Evli’s own funds and direct equity and corporate bond investments to find out whether they contain companies that violate the principles of the UN Global Compact. The UN Global Compact is an international corporate responsibility initiative that requires companies to respect human rights, implement anti-corruption measures and consider environmental issues. It is made up of ten principles, which are derived from the UN Universal Declaration of Human Rights, the ILO Declaration on Fundamental Principles and Rights at Work, the UN Rio Declaration on Environment and Development and the UN Convention Against Corruption. If we discover that a company we have invested in is violating the principles of the UN Global Compact, we will first analyze the situation with the portfolio manager after which the Responsible Investment team will decide on further action. There are two options for further action: to start engagement activities or to place the company on the list of excluded investments. The purpose of engagement activities is to change the company’s practices so that they become more responsible.

Evli also has separate ownership control principles which describe the ownership control methods used by Evli. Evli reports yearly its adverse sustainability impacts on company level according to the SFDR. In addition, as a part of other responsibility reporting Evli reports on the responsibility of its funds and its client portfolios with fund/portfolio-specific ESG reports, which extensively describe the indicators related to responsibility and sustainability impacts. The implementation of the ownership control principles is reported annually on the company’s website and as part of the mutual funds’ semi-annual reports and annual reports.

Information on environmental and social characteristics of discretionary asset management service in accordance with Sustainable Finance Disclosure Regulation. The above information is not applicable to all Evli's asset management portfolios, but excludes individual portfolios due to their investment restrictions, portfolios transferred from EAB Asset Management Ltd, which have not undergone any changes to their investment strategy, and Evli Digital asset management service’s passive strategies with less than 50% Article 8/9 funds.

Fund-specific information on Evli's mutual funds and alternative investment funds in accordance with the EU disclosure regulation is available on Evli’s website at evli.com/en/products-and-services/funds/mutual-funds and evli.com/en/products-and-services/funds/alternative-investment-funds.

Statement and Summary statement on principal adverse impacts of investment decisions on sustainability factors (Summary statement: EN, ET, NL, FR, DE, IT, LT, LV, NO, PT, ES, SV)

Focus areas for responsible investing at Evli

#01

Following market changes

#02

Active ownership

#03

Developing climate and nature work

#04

Addressing human rights

#05

Evli’s responsible products

#06

Continuous ESG-integration

Related articles

View all“Investors can impact climate change in many ways. We help set concrete goals for climate action.”

Maunu Lehtimäki, Chief Executive Officer, Evli Plc

Evli's commitments and investor initiatives

Connect with us