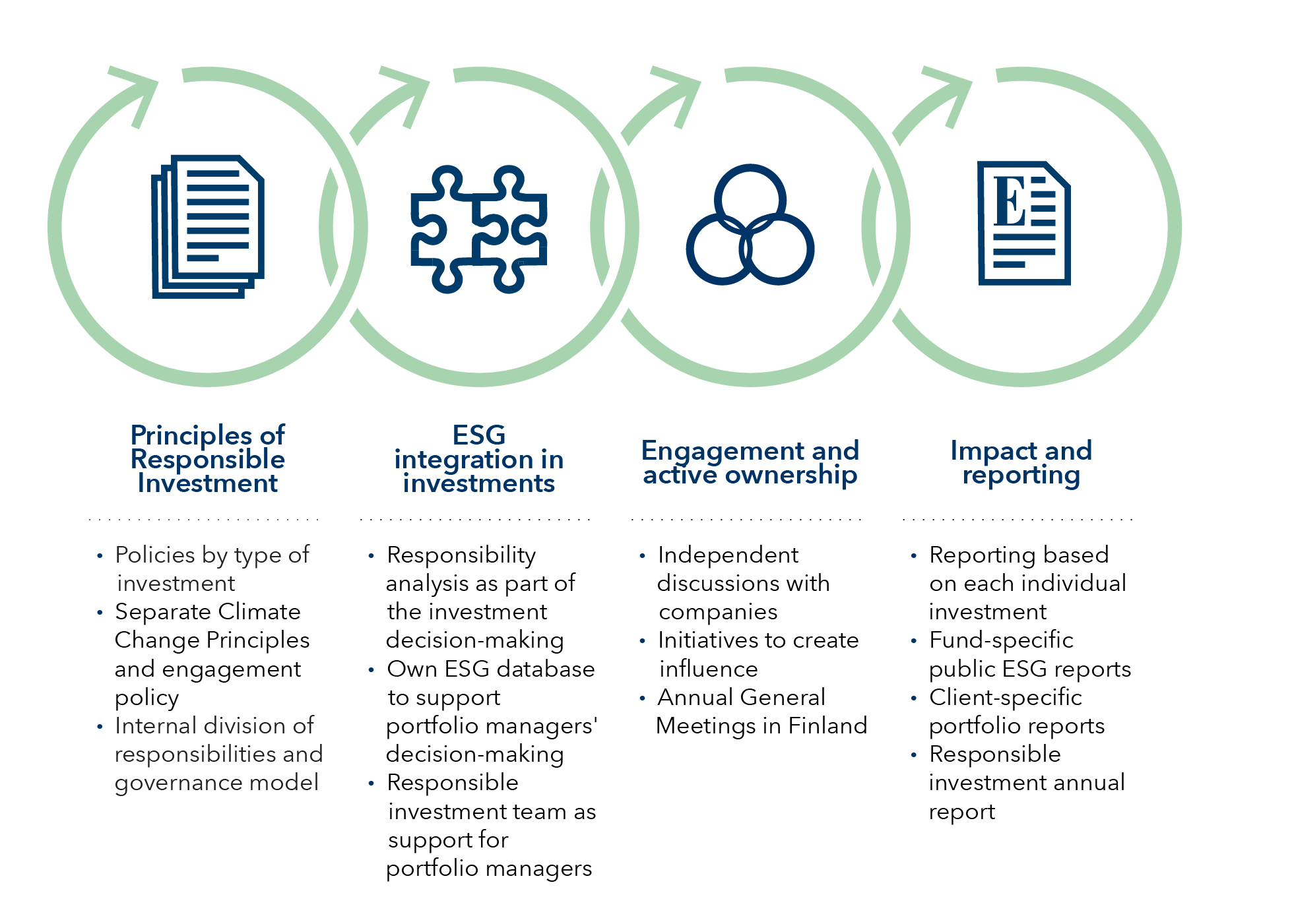

Responsible investing refers to investment activities that take into consideration the environment, society and good governance. Responsibility influences the long-term potential for a company’s success and taking this into consideration in investments also produces results for the investor. At Evli, we want to grow our clients’ wealth in a responsible manner. For this reason, responsibility is integrated into Evli’s Wealth Management investment operations and our funds are managed in accordance with Evli's Principles for Responsible Investment.

Evli's new climate targets aim to make a real impact on investments, businesses and the industry.

All of Evli's equity and fixed income funds adhere to the company's Principles for Responsible Investment.

![]()

Active investments are regularly analysed in terms of ESG (Environmental, Social, Governance) factors. An ESG score is calculated for each fund and direct equity investment, which reflects how well the companies as a whole have taken into consideration the risks and opportunities associated with responsibility.

We monitor our investments regularly and strive to influence the way companies operate. If we observe that a company is violating the principles of human rights, labour standards, the environment or anti-corruption as set out in the UN Global Compact, we seek to influence the company's operations or exclude it from our investments. We also participate in various collaborative engagements and initiatives with other investors and participate in annual general meetings in Finland.

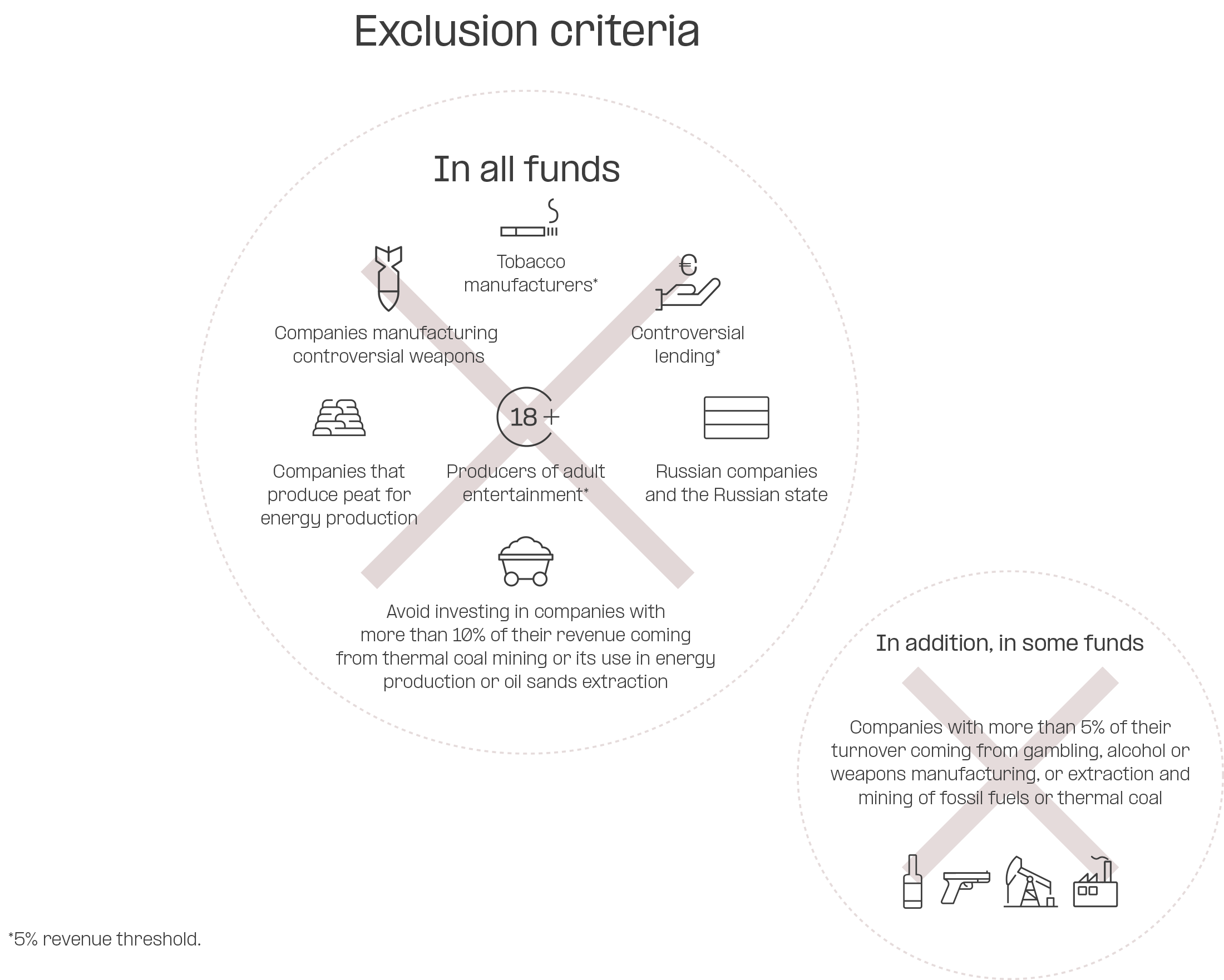

If we observe that a company is violating the principles of the UN Global Compact, UN Guiding Principles on Business and Human Rights, OECD Guidelines for Multinational Enterprises or Evli’s Climate Change Principles, we seek to influence the company's operations or exclude it from our investments. Read more about the exclusion criteria.

Evli's responsible investing is based on transparency and openness, which is why we report responsibility factors comprehensively to our clients. Our responsibility reporting consists of the funds' ESG reports, client-specific portfolio reports and the responsible investment annual report.

Read more from the Principles for Responsible Investment

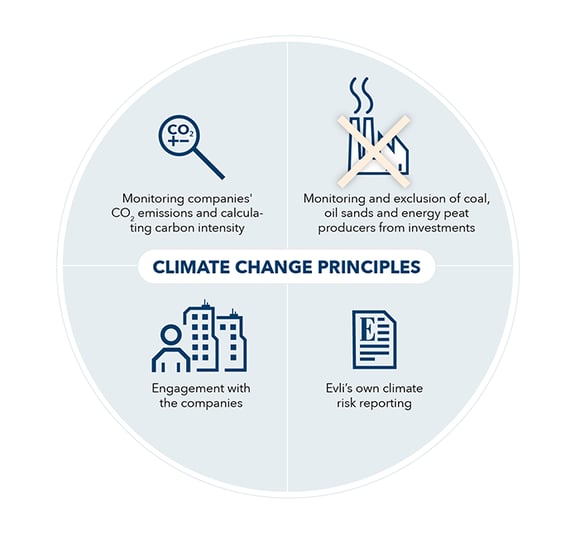

Climate change is one of the biggest threats of our time, and we want to play our part in mitigating it through responsible investment. All of Evli's investments follow the company's Climate Change Principles.

Read more from Evli's Principles for Climate Change.

The TCFD (Task Force on Climate-related Financial Disclosures) is an international climate risk reporting framework that looks at climate change threats and opportunities for companies. We report on Evli's climate risks in accordance with TCFD guidelines. The first report was published within the 2019 Corporate Responsibility Report. In August 2019, we joined the TCFD as a public supporter.

Incorporating biodiversity, or in other words natural diversity, into investing is fast emerging as a significant area of responsibility alongside climate change. Evli has prepared its biodiversity roadmap with action steps for 2023–2025. The objective of the roadmap is to gain a better understanding of biodiversity-related risks and impacts of investments on biodiversity.

Read more about Evli Wealth Management’s biodiversity roadmap

Task Force on Nature-related Financial Disclosures (TNFD) is a market-led, science-based initiative that has developed a reporting framework on nature for financial institutions and organisations. Evli was the first Finnish asset manager to join the TNFD forum in 2022 and will according to Evli’s biodiversity roadmap report according to TNFD recommendations in 2025 based on the year 2024.

Exclusion is one of the most concrete ways to implement the Principles for Responsible Investment. At Evli, exclusion is a two-stage process: certain principles apply to all Evli’s active equity and fixed income funds and investments, in addition to which some funds comply with broader exclusion criteria.

Evli’s equity and corporate bond funds have received ESG4Real certification in 2023.

Evli Plc’s (Evli) Responsible Investment Executive Group approved the following principles regarding the addressing of sustainability risks and adverse sustainability impacts. Sustainability risk refers to an environmental, social or governance event or condition that, if it occurred, could cause an actual or potential material negative impact on the value of an investment. These principles regarding the addressing of sustainability risks and adverse sustainability impacts will be applied whenever Evli Plc invests client assets under its asset management in, and/or whenever it offers investment advice to, the funds managed by Evli Fund Management Company Ltd and the assets under its asset management. Therefore, the same principles will be applied throughout the Evli Group, and the word “Evli” below will refer to all Evli Group companies.

According to the regulation, Evli identifies and takes into account the client's possible preferences related to the sustainability of investments when offering the client discretionary asset management service and investment advice.

Evli takes account of the sustainability risks in its investments and of the principal impacts of its investments on sustainability factors in accordance with Evli’s Principles for Responsible Investment. Adverse impacts on sustainability factors are taken into account in Evli’s asset management and funds through an internal process based on Evli’s Principles for Responsible Investment and Climate Change Principles in a way that does not conflict with the client’s own policies or investment preferences. Evli’s Principles for Responsible Investment are asset class-specific and cover all the active investments under Evli’s management. Fund-specific or asset class-specific principles may vary on how sustainability risks and adverse impacts of investments on sustainability factors are considered. In addition, there can be funds or individual products that do not consider the principal adverse sustainability impacts.

Evli’s Principles for Responsible Investment cover:

Evli Wealth Management Principles for Responsible Investment

Evli’s principles for responsible investment for direct private equity investments and funds

The above-mentioned principles describe how Evli identifies and analyzes sustainability impacts and the related indicators and what Evli’s procedures are with respect to these. One example of a negative sustainability impact is a breach of a norm, i.e. an act that breaches the principles of the UN Global Compact corporate responsibility initiative, for which Evli has specified a systematic procedure. We monitor Evli’s own funds and direct equity investments to find out whether they contain companies that violate the principles of the UN Global Compact. The UN Global Compact is an international corporate responsibility initiative that requires companies to respect human rights, implement anti-corruption measures and consider environmental issues. It is made up of ten principles, which are derived from the UN Universal Declaration of Human Rights, the ILO Declaration on Fundamental Principles and Rights at Work, the UN Rio Declaration on Environment and Development and the UN Convention Against Corruption. If we discover that a company we have invested in is violating the principles of the UN Global Compact, we will first analyze the situation with the portfolio manager after which the Responsible Investment team will decide on further action. There are two options for further action: to start engagement activities or to place the company on the list of excluded investments. The purpose of engagement activities is to change the company’s practices so that they become more responsible.

Evli also has separate ownership control principles which describe the ownership control methods used by Evli. Evli reports yearly its adverse sustainability impacts on company level according to the SFDR. In addition, as a part of other responsibility reporting Evli reports on the responsibility of its funds and its client portfolios with fund/portfolio-specific ESG reports, which extensively describe the indicators related to responsibility and sustainability impacts. The implementation of the ownership control principles is reported in Evli Group’s responsible investment annual report.

Application of the Sustainable Finance Disclosure Regulation in Asset Management Portfolios

Fund-specific information on Evli's mutual funds and alternative investment funds in accordance with the EU disclosure regulation is available on Evli’s website at www.evli.com/en/products-and-services/mutual-funds/funds/nav and www.evli.com/products-and-services/for-investmentfunds/funds.

Statement on principal adverse impacts of investment decisions on sustainability factors

Summary statement on principal adverse impacts of investment decisions on sustainability factors (EN, ET, NL, FR, DE, IT, LT, LV, NO, PT, ES, SV)

At Evli, responsible investing is primarily implemented as part of the day-to-day investment activities. ESG integration, which means the consideration of responsibility factors in portfolio management, is a key part of investment decision-making, the analyses of risks, and the monitoring of companies.

A wide range of factors are taken into consideration when making investment decisions, both in relation to the company and its industry. Responsibility factors are a key part of risk analysis and making investment decisions.

Evli's Principles of Responsible Investing, Climate Change Principles, and the exclusion criteria for all investments set the framework for the investment activities. Portfolio managers conduct analyses of companies and industries and their ESG-related risks and opportunities. The Responsible Investment team supports portfolio managers in their work and Evli's Responsible Investment Executive Group makes decisions on the framework for responsible investment.

With Evli's ESG database, the portfolio managers can easily access corporate responsibility information when conducting equity and fixed income investments and risk analyses. The database enables, among other things, portfolio managers to retrieve companies' ESG ratings, information on the proportion of revenue which is made up of disputed operations, as well as emissions data and possible UN Global Compact violations. These can then be compared with the corresponding data in the benchmark index.

We believe engagement is an important part of responsible investing and often a more effective means than exclusion for bringing about lasting change.

We believe engagement is an important part of responsible investing and often a more effective means than exclusion for bringing about lasting change.

Engagement can be done in three ways: by engaging companies either alone or in conjunction with other investors, by attending annual general meetings, and by holding corporate responsibility discussions in conjunction with ordinary company meetings. The main themes of Evli's engagement are climate change mitigation, respect for human rights, anti-corruption measures, taking environmental issues into consideration, factors related to good governance and the reporting of responsibility factors.

We analyse the active selections made in our equity and corporate bond funds and the direct investments in Wealth Management every three months for potential violations of international principles/guidelines (the UN Global Compact, the UN Guiding Principles on Business and Human Rights, the OECD Guidelines for Multinational Enterprises) and Evli's Climate Change Principles.

For example, the UN Global Compact is an international corporate responsibility initiative that requires companies to respect human rights, actions to fight corruption and take environmental issues into consideration. Information on violations can be obtained from MSCI and ISS ESG databases and from other sources, such as the news.

Every case of non-compliance with the norms and Climate Change Principles triggers a pre-determined process at Evli. The case is first handled with a portfolio manager, after which Evli's Responsible Investment team analyses the company's situation. The Responsible Investment team has two options for further action:

Cases of engagement most often concern environmental problems, human rights, workers' rights or actions leading to climate change mitigation. Evli does not disclose the names of the companies subject to engagement activities, as it believes that confidentiality with the company is more effective.

Collaborative engagement is achieved through, among others, Climate Action 100+, CDP investor letters and PRI projects.

Evli participates in Annual General Meetings and Extraordinary General Meetings mainly only in Finland but may also provide voting instructions to selected foreign Annual General Meetings without attending the meeting itself. Annual general meetings are selected on the basis of the content of their agenda and the wealth management firm’s potential to impact for change, and the final decision on participation is made by the portfolio manager responsible for the fund's investment decisions or the Responsible Investment team.

As part of the investment strategy of some funds, the portfolio manager who makes investment decisions often meets with representatives of the companies on a regular basis. In these meetings, issues about responsibility factors are actively raised. The Responsible Investment team also meets companies to discuss responsibility-related themes. In total, there are hundreds of company meetings each year.

Transparency and openness are the cornerstones of Evli’s responsible investment. We want to report on responsibility factors and the results of our responsibility work regularly and comprehensively, and to continuously develop the reporting methods.

One of our development objectives has been towards innovations in how we report on the responsibility (ESG) of Evli’s equity and fixed income funds. Our newly updated ESG reports provide investors with one of the broadest and most comprehensive reviews of fund responsibility. Addition to the broad and comprehensive funds’ ESG report Evli’s customers are receiving portfolio and investment specific ESG reports.

Due to the continually growing importance of climate change, the updated reports include several indicators related to climate change management, which now forms a separate category of its own. As a whole, the ESG report for each fund consists of the fund's basic facts, ESG key figures, indicators of the investment’s reputational risk, and climate indicators. The report also shows the development of the fund’s ESG ratings and its carbon footprint, as well as the fund's ten largest investments. In addition, the report provides a description of the fund's ESG strategy, approaches to responsible investing, fund-specific exclusions, and a detailed explanation of Evli's engagement work.

Like Evli's previous ESG reports, the updated reports are based on MSCI's ESG database. MSCI is an independent ESG analysis company with an extensive global database. The fund-specific ESG reports are available from the fund-specific information as well as from the ESG reports´ summary page.

Responsibility is an important part of Evli's corporate responsibility report, which complies with the GRI (Global Reporting Initiative) international responsibility reporting standards, where applicable. In addition, we publish an annual report on responsible investment, which details the development of ESG integration in the company and the engagement and exclusion measures.

At Evli, responsibility has been an integral part of business for years. Read about responsibility in Evli's business operations in our Corporate Responsibility Report.

Lue lisääEvli has made children's rights one of the focus areas of its responsible investment work, as investors have power to influence how children's rights are implemented in companies’ operations.

Read moreEvli was placed first in sustainable investments expertise in the Kantar Prospera "External Asset Management 2023 Finland" survey.

Read moreChoosing the right strategy is the key to all successful investing. This is how we, at Evli Fund Management, incorporate ESG in the investment process.

“We enable our investors to address the challenges of climate change and pursue concrete goals for their portfolios,” explains Maunu Lehtimäki, CEO of Evli Plc.

Responsibility is at the core of Evli's strategy and is based on transparency and openness. Find out how Evli implemented responsible investing in 2022.

Read the Annual ReportPRI works to understand the investment implications of ESG factors and to support its investor signatories in incorporating these factors into their investment decisions. Evli reports its responsible investing activities according to PRI's reporting framework.

Read Evli's RI Transparency Report 2021

As the value of mutual funds may rise or fall, it is not certain that you will always get back the invested assets. Past performance is not a guarantee of future returns.

×We ask you to take into account the fact that Evli Plc’s ability to offer services to states outside of the EEA or to citizens of these states may be affected by limitations related to license. Users of the website are personally responsible for any national limitations that may affect them.

Currently no Evli funds are registered for distribution in Belgium. If you are a Belgian professional investor and interested in some Evli funds, please contact us at fundinfo(a)evli.com