US President Donald Trump’s second year in office began at a brisk pace with a series of geopolitical actions. US special forces captured Venezuelan President Nicolás Maduro in Caracas, Trump stated that he wanted to acquire Greenland even by force if necessary, and he threatened military action against Iran in response to unrest in the country. Negotiations over the war in Ukraine were also under way.

Trump threatened eight European countries with additional tariffs unless they accepted the takeover of Greenland. The tariff threat was later withdrawn following a preliminary NATO agreement. Despite the reversal of the tariff plans, relations between Europe and the United States have become severely strained. Unrest was also seen within the United States as a result of heavy-handed actions by border authorities.

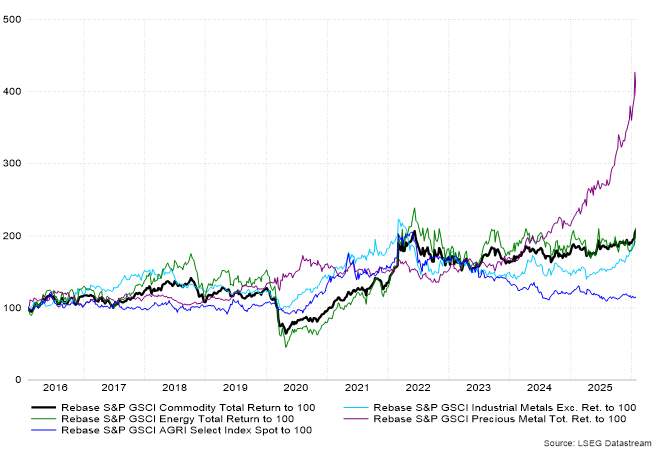

The events of January led to an accelerating weakening of the US dollar and a sharp rise in gold prices. The EUR/USD exchange rate reached 1.20, marking the dollar’s weakest level in five years and approaching its ten-year low of 1.25. Gold prices rose by as much as 17 percent, while silver prices surged by as much as 38 percent. Over the past two years, the price of gold has increased 2.5-fold and silver 4.3-fold. Both prices, however, declined clearly from their peaks toward the end of January. Bitcoin fell by more than 5 percent against the US dollar. These sharp price movements are widely seen as reflecting reassessments of US economic and monetary policy.

Hawk or dove as Fed chair?

Federal Reserve Chair Jerome Powell was charged over exceeding the budget in the renovation of the Fed’s main building. The charges are believed to stem from the rift between Powell and President Trump over interest rate policy. Markets reacted negatively to the perceived political pressure. In any case, Powell’s term ends in late May, and Trump has nominated Kevin Warsh as his successor. Warsh served as a member of the Federal Reserve Board from 2006 to 2011, during which time he favored a tighter monetary policy stance. More recently, he has been critical of the Fed’s current leadership and has called for interest rate cuts, a reduction in the central bank’s balance sheet and closer coordination with the US Treasury. The nomination still requires Senate confirmation.

Market expectations of Fed rate cuts resurfaced. Markets are again pricing in a cut of 0.25 percentage points at the June and December meetings. At its meeting in late January, the Fed left its policy rate unchanged. Consumers’ inflation expectations for the current year have remained clearly above 3 percent. The five-year inflation rate implied by bond markets has remained stable at around 2.5 percent.

Equities off to a strong start in 2026

Equity markets rose strongly, led by emerging market equities. Equity markets in Brazil, South Korea and Turkey performed particularly well. Japan’s equity markets also posted a solid gain of nearly 4 percent. European markets rose by three percent, while the US S&P 500 Index gained slightly more than one percent. US equity markets continued to be weighed down by developments in the technology sector. For example, Microsoft’s share price declined despite better-than-expected earnings. Apple’s results were met with a mixed response, while Google’s and Meta’s earnings were received enthusiastically.

Figure: Precious metals prices have risen sharply