In December, US equity markets traded largely sideways as investors assessed developments in artificial intelligence and related capital flows. Major cloud services provider Oracle was in focus with attention centering on its earnings performance, outlook and equity price

In Europe and the Nordic region, equity markets remained buoyant. The MSCI Europe Index rose by 2.8%, the OMX Nordic 40 Index by 4.4% and the OMX Helsinki Portfolio Index by a notable 4.9%.

Central banks delivered widely expected policy decisions in December. The US Federal Reserve and the Bank of England cut their interest rates by 0.25 percentage points, while the European Central Bank left rates unchanged. The Bank of Japan, meanwhile, raised its interest rate by 0.25 percentage points to 0.75%. Most central banks are expected to pause rate adjustments in early 2026. Markets, however, anticipate that the Fed will continue easing monetary policy during the year, moving toward 3%. Changes in the composition of the Federal Reserve’s Board of Governors may influence how the fixed income markets interpret the future policy path.

President Zelensky and President Trump once again held talks on Ukraine’s future toward the end of December. No agreement was reached on Russia’s territorial demands, and Russia showed little willingness to compromise. The United States increased its activity in Central America and stepped up pressure on Venezuela. Reactions in commodity markets were muted, and the price of crude oil continued to fall, reaching its lowest level since spring 2021.

2025 in review

Sharp shifts in US foreign and trade policy under President Trump generated uncertainty in the spring, ushering in a new phase in relations between Europe and the United States. Russia’s war in Ukraine continued, prompting increased defense and infrastructure investment across Europe. NATO also updated its defense targets. In the Middle East, a fragile ceasefire was reached between Israel and Palestine.

AI played a central role in US economic growth, while simultaneously fueling concerns about an equity market bubble and a slowdown in job growth. Europe’s economy struggled with structural challenges and weak public finances, particularly in France and the UK. Germany’s new government approved a major investment and defense program that is expected to support the country’s economic growth in the coming years.

Despite political uncertainty, capital markets proved surprisingly resilient. Investor risk appetite remained intact, and equity markets rose globally. The US dollar weakened and the price of crude oil declined. Many metals, including copper, silver and gold, appreciated in value. Inflation moderated and central banks continued to ease monetary policy.

Our scenarios for 2026

Baseline scenario: Global economic growth will remain strong, although trade tensions between the United States and China and broader geopolitical risks will continue to create uncertainty. China’s economic outlook is stable but subdued, shaped by structural challenges and external risks. In Europe, growth will be supported by investment, domestic demand, strong labor markets and easing inflation, though geopolitical tensions and trade barriers could slow the momentum. In the United States, investment activity and tax changes will support growth, but unemployment is rising slightly and consumer confidence is weakening. Central banks may further ease monetary policy, which would support both economic and market outlooks.

Downside scenario: Key risk factors are linked to uncertainty surrounding the US economy and policy direction. A faster-than-expected deterioration in labor markets could increase recession fears. The likelihood of a sharp equity market correction may rise; if this happens it could have a negative impact on consumer confidence and corporate investment. A renewed escalation in geopolitical risks cannot be ruled out.

Upside scenario: Demand-driven global economic activity is recovering rapidly as longer-term optimism strengthens. Investment is increasing worldwide amid a shifting operating environment, and productivity is improving in different regions. In the EU, structural reforms are being implemented, which are easing the operating environment for businesses and boosting household incomes. Inflation remains close to central bank targets, supported by expanding global supply and productivity gains. De-escalation is being seen in the Middle East and Ukraine and in relations between China and the United States.

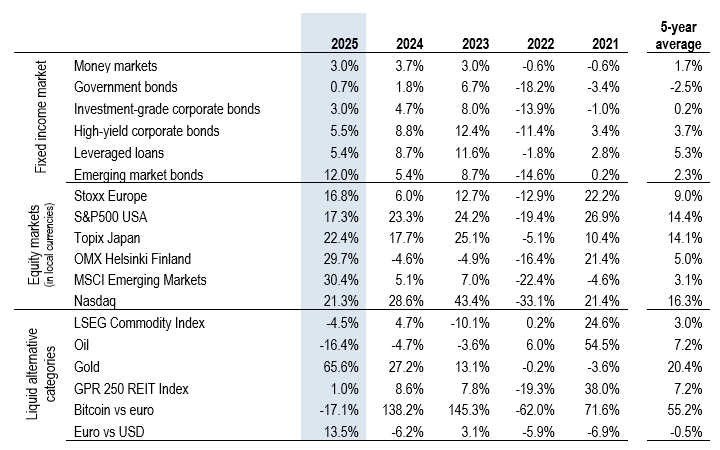

Table: Market performance over five years