Amazon, Alphabet, Meta, Microsoft and Oracle continue to expand the computing capacity of their data centers. Their combined investments are expected to exceed USD 530 billion next year, and to grow significantly in the coming years as well.

The companies are increasingly financing data-center construction with debt rather than cash. However, when they released their third-quarter results, the market reaction was negative. Nvidia’s equity price declined despite a clear earnings beat and strong guidance. Investment-cycle costs and one-off expenses introduced volatility to the equities of other companies. The exception was Google, whose equity price rose nearly 15%.

US economy weakened as expected

In the United States, labor-market demand is showing signs of weakening. In recent months, tariff uncertainty has slowed hiring, but the unemployment rate remains historically low due to reduced immigration. The federal government shutdown interrupted the release of official economic data, prompting investors to focus more on private-sector reports. According to the Challenger report, 153,000 layoffs were announced in October. The University of Michigan Consumer Sentiment Index fell to 50.3 in November, from 53.6 in October.

Expectations of a Federal Reserve policy-rate cut increased as labor-market conditions deteriorated. The Fed lowered its policy rate in October, and markets now assign an 80% probability to a further cut in December.

The euro area economy grew by 0.2% in the third quarter, exceeding expectations by 0.1 percentage points. The French economy expanded by 0.5%, beating forecasts by 0.3 percentage points. The German and Italian economies showed no growth. Key drivers of euro-area growth included defense and aerospace industry exports. The unemployment rate in the euro area has been declining steadily in recent years and stood at 6.3% in September. The euro area economy is expected to grow 1.4% this year and 1.5% next year.

Trump still adjusting tariffs on China

President Donald Trump met with President Xi Jinping. China agreed to postpone export restrictions on rare earths for one year, while the United States committed not to impose previously threatened tariffs. President Trump also reduced tariffs across a broad range of product categories, and the average tariff level is now estimated at 39%. The numerous overlapping and product-specific tariffs make the exact figure difficult to determine. Although there was no major progress on technology or security issues, both sides emphasized the importance of maintaining open channels of communication. Markets viewed the easing of tensions as a positive development.

The US Supreme Court is assessing the legality of President Trump’s tariffs under the International Emergency Economic Powers Act (IEEPA). The significance of the ruling is primarily legal: it will define the limits of presidential authority and influence future precedent. The economic impact will depend on how extensively the President uses other trade laws to impose tariffs. A decision is expected in the coming months.

The United States also unexpectedly announced a peace plan to end the war in Ukraine. The initial 28-point proposal was widely viewed as pro-Russian. However, no final agreement was reached by the deadline.

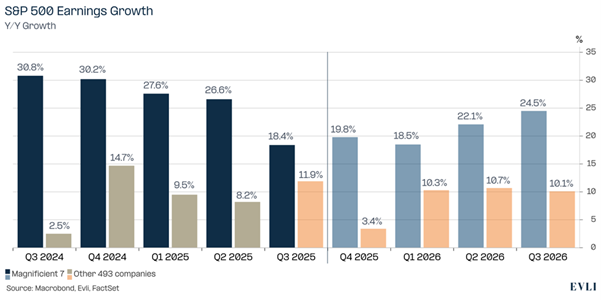

Image of the month: Strong earnings growth expected to continue in the US