One of Finland's most prominent research universities believes that all academic institutions should include investments in their carbon footprint calculations. But how does one steer a large and highly diversified portfolio towards net zero?

The University of Jyväskylä has an ambitious environmental program that aims to achieve carbon neutrality and no net biodiversity loss by 2030. What makes its program exceptional is that the goals also apply to its investment portfolio.

"Our carbon footprint calculations have shown that the largest footprint comes from our investments," says Vesa Kupari, responsible for preparing the university's investments. In 2020, investments accounted for nearly half of the university's overall carbon footprint.

The main goal is to achieve carbon neutrality in the broad portfolio by 2035. Carbon emissions will be reduced by 30% by 2025 and 70% by 2030. Kupari says the road ahead is long, and one the university cannot walk alone.

"From our perspective, the first and the most important task is that we don't only look at individual investments because our portfolio is highly diversified. We must collaborate with all our asset managers."

Transition and solutions at the core of the carbon-neutral strategy

An essential step in achieving carbon neutrality is to assess what kind of investments are in the portfolio and calculate their carbon footprint and carbon intensity. Here, the university's researchers and solid in-house sustainability knowledge are invaluable.

Doctoral researcher Sami El Geneidy, one of the researchers working on the carbon intensity calculations, says that the analysis reveals a lot about how different companies affect the environment. For example, it was discovered that in a specific part of the portfolio, the ten most carbon-intensive companies accounted for only 4% of the total value but 40% of the carbon intensity.

"Analysis shows that a small number of companies have a big impact on the overall carbon intensity. These are the areas we need to start looking at," El Geneidy says.

The data helps the university, and its asset managers, make better investment decisions. Excluding specific companies or industries is not the university's primary option, as it wants to focus on supporting the net-zero transition. However, if over 30% of a company's revenue comes from coal and the company doesn't have a convincing strategy for the transition, it will be excluded from the portfolio.

Ulla Helimo, a sustainability and responsibility expert at the university, says there's a shared understanding that the point is not to achieve a net-zero portfolio instantly but to support the transition with investments.

"That's why we need to measure our portfolio in different ways. We don't only measure the carbon footprint but carbon intensity too. In addition, we track controversial companies and aim to support the companies that are part of the solution, even if they are now still part of the problem."

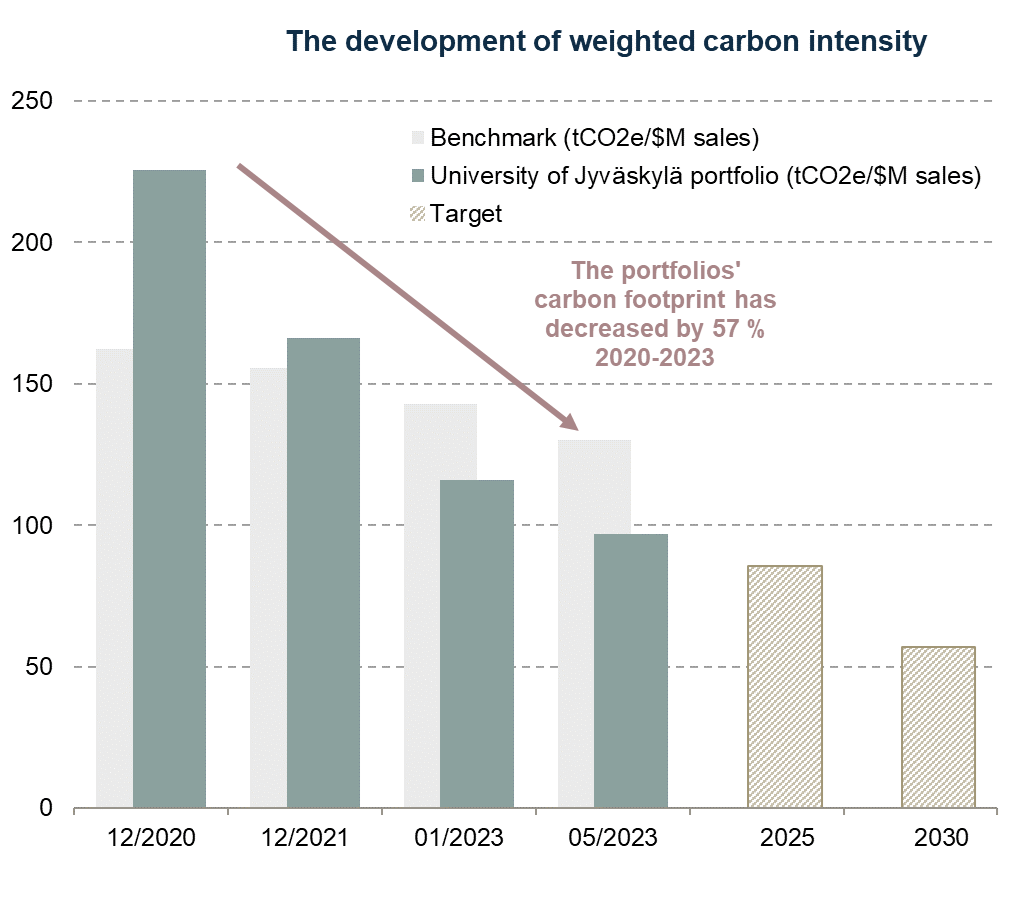

Evli monitors the carbon footprint of the University of Jyväskylä's asset management portfolio with its weighted carbon intensity. The weighted carbon intensity of the investment portfolio has halved since 2020. In May 2023, the average carbon intensity of the investments was 97 tCO2e/$M Sales. Source: Evli, MSCI

Evli monitors the carbon footprint of the University of Jyväskylä's asset management portfolio with its weighted carbon intensity. The weighted carbon intensity of the investment portfolio has halved since 2020. In May 2023, the average carbon intensity of the investments was 97 tCO2e/$M Sales. Source: Evli, MSCI

Evli's climate portfolio supports achieving the goals

The journey towards carbon neutrality was properly kicked off at the end of 2022 when the university board approved the metrics for monitoring the sustainability goals of investments. Kupari emphasizes that the work is just getting started.

"We don't expect to do magic tricks, but we have already done something. A good example is the climate strategy for the assets managed by Evli. It's a concrete step, and we expect it to have concrete, long-term results."

Evli's climate portfolio is an asset management strategy that aims to reduce the portfolio's carbon emissions and direct investments in climate solutions based on the client's goals. Careful allocation and risk analysis are at the core of the strategy, and investments can be made in both funds and stocks.

The University of Jyväskylä is Evli's long-time client and one of the first organizations to adopt the climate strategy approach. So far, the university and Evli have examined the portfolio makeup and started to reallocate assets in a controlled manner to achieve the university's climate goals.

Kupari appreciates collaboration with Evli and praises the active and open discussion around the carbon neutrality goals.

"Evli takes our investment goals into account, and the same goes for responsible investing. The climate strategy is a prime example of that."

One can find many similarities between the university's environmental program and Evli's climate portfolio strategy. Carbon neutrality is achieved over time in a controlled manner, focusing on transition and constantly assessing the goals. Another shared trait is the focus on solutions, Helimo adds.

"Evli has been a forerunner in these topics. Our collaboration has been an ongoing dialogue, and we've been bouncing around ideas and coming up with solutions together."

Responsible investing requires endurance

Responsible investing is a risk management tool for the university, in the same way as diversification.

"We don't expect to get better results because of responsible investments automatically, but we believe to be more likely on a solid foundation with them," Kupari says.

The work to achieve carbon neutrality is now on. The project will be long and require tenacity and endurance, Kupari describes. Every year, the university and its partners must assess if the goals are met and if they are still relevant.

"This will be an ongoing dialogue with our asset managers until 2035 when we set new goals."

In the end, carbon neutrality is just one, albeit very important, aspect of the university's responsible investments. Social issues and good governance must also be considered in all investment activities.

"We also have a financial responsibility; we cannot waste the university's money, as it is intended to be put to good use. So, there are four sides to responsibility," Kupari explains.

Going forward, the university aims to measure the biodiversity footprint of its investments. El Geneidy and his colleagues are currently working on this methodology. Discussions about biodiversity footprint have also been started with Evli.

"Measuring biodiversity footprint in investments is developing at a fast clip. Ultimately, it's similar to the carbon dioxide equivalent by bringing the impacts on biodiversity under one metric. It's nothing more special than that," El Geneidy explains.

The University of Jyväskylä was the first university in Finland to include investments in its carbon footprint. It has encouraged other universities to do the same, increasing openness about the environmental footprint of investments. El Geneidy believes that investments are a central part of universities' impact on society.

"There's a lot of talk about all the good that comes from education, which is important, but investments have the same kind of power to an extent. We could use them to do a lot of good, and that's why I believe they an important part of the bigger picture."

Read also:

A strong heritage of ESG gives the Nordic market a sustainable advantage