Green corporate bonds are growing in popularity, but it can be tricky to figure out just how green these investments really are. How do you know when ‘green’ is really green and not just a catchy name of the bond?

The best way is to build a solid ESG foundation and find tangible evidence. Of course, you can look at the specifications of the corporate bond itself, but it is also good to study the company's broader environmental goals.

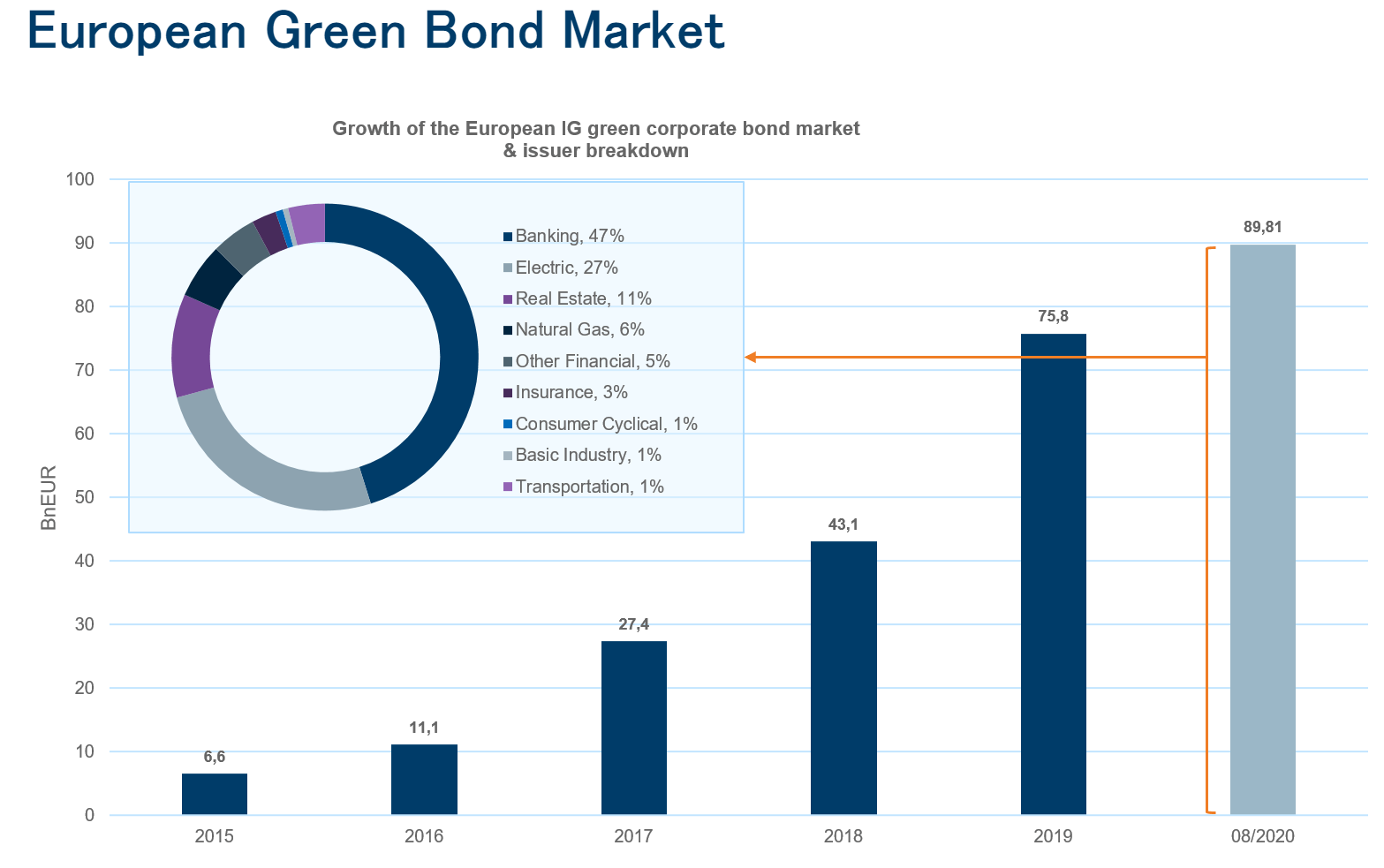

It used to be that ‘green’ was only an issue for environmentalists who saw corporations as part of the problem. But now it is the companies themselves that are taking on an increasingly important role in tackling environmentally important challenges. This is also reflected in the growing number and popularity of green corporate bonds, which are bonds focused on the financing of green projects.

Source: Evli & Bloomberg

Also, from the investor’s point of view, green corporate bonds represent an interesting new alternative. But many are sceptical of the term 'green', and for good reason: if an unambiguous set of environmental impact indicators doesn’t exist, your definition of ‘green’ could differ from that of the big energy company on the other side of town. So how do you know if the green in your investment is really green?

It takes skills in both credit and ESG to be successfully green

You need a wide range of expertise when investing in green corporate bonds. Not only does it require proficiency with fixed income investments, it also demands an extensive knowledge in how to analyse the responsibility of investments.

This is where Evli’s strengths come into play, with the new Green Corporate Bond Fund combining two areas in which Evli has vast expertise and long tradition: corporate bonds and ESG.

So, maybe you like the idea of green bonds, but don’t want to touch government bonds? No problem, the Evli Green Corporate Bond Fund focuses exclusively on green corporate bonds. And that’s rare across Europe. Many of the other green bond funds include a pretty big proportion of government and quasi-sovereign bonds. Instead, we wanted to launch a product that only consists of corporate bonds. This allows us to provide a clearly targeted green solution as part of the corporate bond allocation in your portfolio.

In addition to our long track record of expertise in corporate bonds, the Green Corporate Bond Fund also builds on our solid ESG know-how. Evli has a long tradition in ESG investing, and responsibility is also one of our strategic focus areas. All Evli funds adhere to the principles of responsible investment, which set criteria for the exclusion of controversial sectors and ensure that responsibility is actively taken into account in our investment activities.

A truly green corporate bond is tangible and fits into the bigger picture

But what does the ‘greenness’ of a corporate bond really mean - and how will it be observed in our new fund? Do we just take the issuer at their word and trust them to do something green? No, we put them under the microscope and monitor them to ensure that they keep their promises.

When a company issues a green corporate bond, it must prepare a document on the purpose of the corporate bond and the expected environmental impact. This document is called the green bond framework. The due diligence needed to examine and understand this is the most important step in finding out the true greenness of the bond.

The corporate bonds selected for Evli’s new fund must first comply with the ICMA's green or sustainable bond principles. They include recommendations to issuers on how the use of proceeds, the project appraisal and selection processes, the management of the proceeds and the reporting should be depicted in a green corporate bond framework.

In certain cases, we may also invest in corporate bonds that do not comply with ICMA principles, provided that the issuer's operations as a whole can be considered responsible (so-called pure play issuers). These types of cases include, for example, companies that produce wind turbines or solar panels.

The framework for a green corporate bond must clearly describe what kind of projects are involved. In particular, we look at the use of proceeds, i.e. what types of projects will be undertaken with the funds raised from issuing the corporate bond? Eligible projects may include, for example, those related to renewable energy, pollution prevention, adaptation to climate change, the circular economy or green construction projects.

It is also good to look for things that are really tangible in the framework. For the investor, it is helpful to lay out the project selection criteria and the expected environmental benefits and describe them as precisely as possible: the more tangible the framework, the better it will help the investor to assess the greenness of the corporate bond and thus its suitability for one’s own portfolio.

In addition to the corporate bond itself, it is also important to analyse the company's broader strategic goals and how well the green corporate bond fits into the issuer's other activities from an ESG perspective. A conflict can arise even from a carefully documented green corporate bond if the issuer's other activities are harmful to the environment or the company's operations are otherwise deficient based on an ESG analysis.

Of course, greenness is not just about talking and planning. Green bond issuers pledge to publish an annual report which follows up on the use of proceeds and the impact of the projects. Evli’s Green Corporate Bond Fund will also publish an annual fund-level impact and allocation report based on these reports.

Responsible investing requires close cooperation between portfolio management and the responsibility team

When it comes to both generating returns and contributing to the implementation of environmentally friendly projects, it is necessary to analyse the risks and opportunities from many different perspectives for each investment target. Few investors have the time or expertise to do so, in which case the choice of investment product plays a major role in achieving these goals.

People often say that responsible investing is the ‘new normal’. It goes without saying that investors require portfolio management to be based on a clearly open strategy, careful analysis and robust know-how. In the new normal, similar requirements extend to responsibility: clear criteria must be established, the state of environmental and social impacts must be systematically monitored and, if necessary, better reporting or more responsible actions must be required from companies in the investment portfolio.

In order for green corporate bonds to be truly green, therefore, the dialogue between portfolio management and the responsibility team needs to be closer than ever before. Done right, this close cooperation allows European corporate bond investors to make greener investment choices without compromising on their return expectations. The same way that a car buyer doesn’t need to choose between the extremes of a Prius or a Mustang, when he or she can choose a Tesla instead and enjoy the best of both worlds.

{{cta('e7c68899-2468-4f4e-98e6-6ab04febccd7')}}