At a time when stocks and bonds seem to be falling off a cliff in tandem, diversifying your portfolio with assets that withstand inflation and unlock the value hidden in unlisted companies is the key to a good night’s sleep, experts say.

Does the present political and macroeconomic environment – with geopolitical jitters, recession fears, skyrocketing inflation and central bank rate hikes of a magnitude not seen for decades – signal a return to the bleak 1970s? While history seldom repeats itself exactly, the shift in sentiment has certainly left many investors seasick from trying to navigate the wobbly seas. Much conventional wisdom has been challenged lately, one example being the popular 60/40 investment strategy, where 60 percent of the portfolio is invested in equities and 40 percent in fixed income.

The rationale behind splitting a portfolio between equity and fixed income rests partly on the fact that fixed income can provide a safe haven in times of declining stock values. But, what happens when both asset classes decline simultaneously, albeit for different reasons? That is exactly the development seen lately, as US investment company KKR points out in a new report: “The structural relationship between stocks and bonds, particularly during volatile markets, is changing. In particular, we believe that not only are forward returns likely to be lower but also that bonds can no longer serve as shock absorbers or diversifiers when paired with equities.”

Kim Pessala, Head of Institutional Wealth Management at Evli, agrees that the positive correlation between bonds and stocks has become much stronger: “It is a multi-faceted but interesting situation, and certainly more challenging to investors than, for example, the financial crisis of 2008/09 when monetary easing and zero interest rate targets made fixed income a very comfortable cushion in an investor’s seat.”

Enrich the pie

Pessala points out, however, that large professional investors such as government pension funds have anticipated the change for a long time and restructured their asset portfolio accordingly. “This does not necessarily signal that the 60/40 model should be abandoned altogether, but rather enriched with new asset categories to spread the risk and secure a stream of income in times of rising inflation.” How, exactly? “My advice is ‘diversify, diversify, diversify’, by adding new types of assets when making investment decisions or rebalancing the portfolio. Clients with all their resources tied up in stocks and bonds are not very happy at the moment.”

On the equity side, new types of assets to season an investor’s pie may include shares in unlisted companies or investments in private equity funds and funds focused on infrastructure and property where dividends and other payments are adjusted for (a currently rising) inflation. “In times of high inflation, especially infrastructure offers stable income in the form of rents and lease contracts that are often indexed,” says Pessala and adds, “We’re talking real money here and not excel money.”

Piggy-backing on the investment savvy and resources in private equity companies, for example, was previously an option only for larger investors able to spare 100 million SEK or more. “New ways of structuring via for example fund-of-fund solutions have opened up for smaller tickets down to 1 million SEK as well,” explains Pessala.

As for fixed income, the asset class (or 40 percent pie share) may be broadened to include private credit, a wide asset class including unlisted securities such as debt issued by private equity firms to finance acquisitions, or leveraged loans such as club deals involving several banks. “The benefit of leveraged loans is that they often offer floating-rate notes (FRN), thus providing shelter in times of rising interest rates,” says Pessala.

To smaller and midsized investors, however, the entry barriers to these alternative investments have traditionally been insurmountable – both in terms of minimum investment required, the duration of the investment and the capacity to find, screen and select the right investments. Now that’s all about to change, says Pessala, who believes that smaller investors should also be able to benefit from the so-called illiquidity premium normally assigned to unlisted stock and other alternative investments.

Increasing democratization

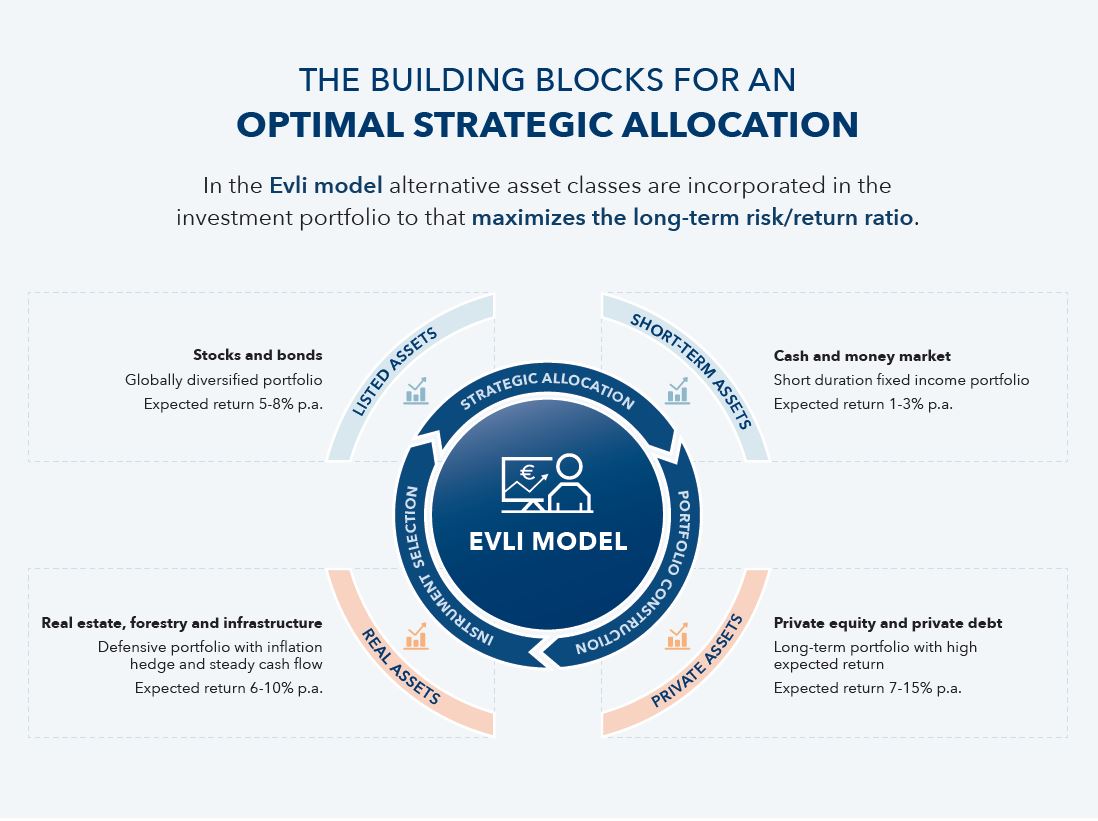

“The mission of Evli is to make it possible for both institutional and smaller investors to build a portfolio that is as diversified and well balanced as those managed by larger pension companies and other professional investors, with a mix between equity, fixed income and alternative investments such as unlisted companies, venture capital, private equity as well as real assets in property, energy, utilities, infrastructure and forest, and private debt.”

KKR agrees, stating that “increasing democratization of alternative asset classes is creating a compelling opportunity for all investors to harness the illiquidity premium in a potentially more thoughtful way… looking ahead, we believe that thoughtful portfolio construction will now involve enhancing the equity component with asset classes that are more likely to appreciate in an inflationary environment.”

The investment company continues: “We think that increasing diversification to enhance portfolios so there are ‘more ways to win’ is important in the environment that we believe we are entering. In a stagflation scenario where inflation rises and growth falters, bond prices would mechanically fall and equities would follow suit. In such instances, asset classes like Private Real Estate and Private Infrastructure with lower dependence on growth and superior inflation properties could act as ‘risk-off’ beneficiaries.”

Phil Waller, co-manager of JPMorgan’s Global Core Real Assets Trust argues, "For those looking to potentially cushion the effects of inflation upon their portfolios, investing in real assets offers not only inflation hedging benefits but also access to a broad range of exciting trends across a variety of sectors.”

Patience is another antidote to sleeplessness, suggests Pessala: “Building an optimally diversified portfolio takes time and patience, and requires some advanced modelling to attain and visualize the changing risk levels, liquidity profile and to generate a desired cashflow. Don’t get stuck with a product mix that is unbalanced. Don’t buy from sales reps but from experts.”

To conclude, the key to a good night’s sleep in times of market turmoil is spelled diversification, according to Pessala as well as market observers such as Morningstar: “Whether investors have access to the right products to sufficiently diversify their portfolios to withstand potential downturns is a different matter… As always, a well-diversified portfolio with a long-term horizon is an investor’s best friend.”

Read also

Infographic: Time to rethink the 60/40 allocation strategy

Unlisted infrastructure offers unrivalled downside protection

Forestry leads the way towards a carbon-neutral portfolio

Private Debt provides stable income and excellent risk-adjusted returns

Private equity allows access to attractive sectors and companies outside listed markets

Unlisted real estate adds stability to the portfolio in the long run