Imagine this: you just had a great year in credit. Eager for more in 2020. Defaults remain low. Spreads are tighter. But there are still attractive yields in low-rated or long-dated bonds. So, you go all-in for more risk and duration. After all, when the market is on fire, you can’t lose, right?

We disagree. Why? When times are good, wise credit selection is more crucial than ever. In our opinion, short-dated crossover offers the best risk-return, with a very low likelihood of negative returns.

One factor to watch could be effects of the coronavirus. We have recently seen virus-related market turbulence, which has shown that the crossover market is much more stable than the High Yield market. Another factor could be the news flow from the ECB’s review of its monetary policy strategy. If bad news comes from the ECB’s review, it could drive credit spreads much wider, particularly in the low-rated and longer-dated issues.

If you fly too high (in yield), you may get burned

Investors are sitting on high cash levels and desperate for positive returns. The ECB will keep interest rates negative for a long time and other central banks are easing. The ECB’s buying of corporate bonds will keep demand for short-dated, positive-yielding paper extremely high, and we believe this puts short-dated crossover credit in a prime position.

In contrast, while the demand for low-rated and longer-dated bonds is strong for now, it is much more vulnerable. A change in market sentiment or tone from the ECB could blow out spreads in these bonds, even while the ECB’s buying program sustains demand in the short-end.

Euro High Yield was strong in 2019, particularly ‘BB’ rated issues. So, you might ask, if things are going well, shouldn’t we dive a little deeper into risk for the higher-yielding ‘CCC’ issuers? No. This would require greater optimism for growth. Our moderate growth expectations put ‘BB’ issuers in more of a sweet spot. While it’s true that macro tail risks have been fading, the growth outlook is not spectacular enough to be bullish on ‘CCC’ rated issuers.

Current HY spreads still compensate for worsening default scenarios. However, historically, at the current, tighter-than-normal spread levels, the 1-3 year spread moves that follow have tended to be a reaction to other, non-systematic factors - not default risk - and these reactions have been more extreme in the lower-rated classes (‘B’, ‘CCC’). Keep in mind that the number of distressed issuers has actually risen in the past 3 years, even while overall spreads were tightening.

Crossover combines the best IG yield with the best HY quality

Shifting from pure-IG into a crossover mix of IG and HY ‘BB’ issues produces a higher yield and even diversifies some risks, such as interest rate risk, as ‘BB’ bonds are less sensitive to rates moves. IG investors recognise that ‘BB’ rated bond issuers are high quality and stable cash flow generators, many of those issuers being former IG-rated companies that are simply not in a hurry to get back into Investment Grade.

The number of IG investors extending into the ‘BB’ category fell during 2019 after the ECB tapered purchases at the end of 2018 but, as the purchases rev back up (and as hybrids are now more expensive), we can expect a resurgent demand for ‘BB’ rated bonds from IG investors in 2020.

We also anticipate a healthy demand for Euro IG issues in the short-end. Earlier last year, the amount of Euro-denominated corporate bonds with negative yields peaked at well over EUR 900 billion but this figure has dropped significantly. Given the open-ended nature of the CSPP program, the demand in Euro IG will have a technical support, which also stabilises volatility, that does not exist in the US IG market, for example.

Why do we like Nordic issuers? Because they have IG-like credit quality at HY-like yields. Nordic credit returns have outpaced Euro IG returns in recent years, and that’s without the participation of indices, passive instruments or ‘hot money’. Despite smaller issue sizes, the secondary market liquidity is closer to that of Euro IG than HY.

These Nordic unrated issues often give excess yield of 50-150 bps vs. Euro Corporates. This excess yield is a risk premium which reflects the lack of a formal credit rating, and not a reflection of higher credit risk or poor liquidity. Also, unlike the sometimes mad scramble for Euro IG issues, the ECB is pretty much a non-existent rival for most Nordic credits, since Sweden, Norway and Denmark are ineligible and only a fraction of the Finnish credit issues can be purchased by the ECB. This is another reason for the wider spreads. But, no problem, us local Nordic investors are happy to pocket those extra returns.

Increasing yield and still keeping default risk low?

When moving from ‘BBB’ to ‘BB’ bonds in today’s market, you gain access to more yield, but you don’t need to worry about default risk rising significantly. That’s because we expect defaults to remain low in 2020. HY issuers face very modest debt maturity walls in the next 2 years and the low rate environment has made debt servicing much easier than in past decades. HY issuer fundamentals remain healthy, for the most part, and the rise in net leverage in 2019 can be largely attributed to the introduction of IFRS 16 at the start of the year.

The addition of Nordic, unrated bonds also offers good returns, lower volatility and a further diversification of default risk. The Nordic economies and bond issuers are stable and fundamentally healthy. The end investors are typically local and long-term oriented. And there’s upside potential too: if a Nordic, unrated issuer receives an official rating, there is a possibility for significant spread tightening, from what we’ve witnessed historically.

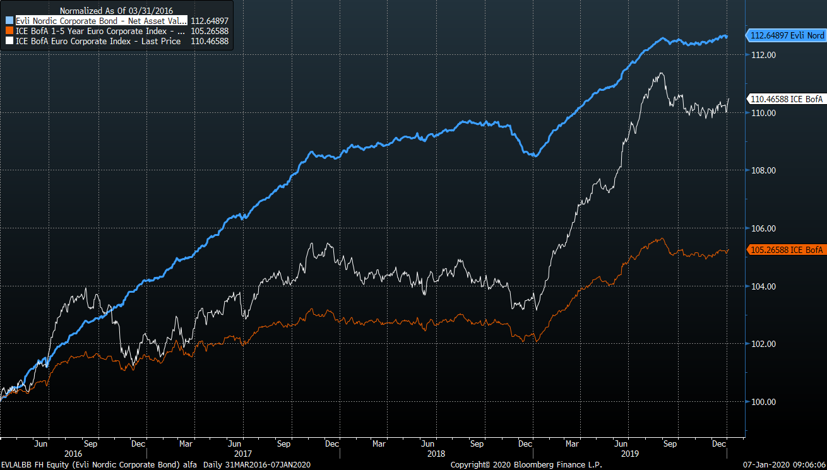

Nordic Corporates offer excess return with lower volatility

Source: Bloomberg. Evli Nordic Corporate Bond fund since current strategy inception end March 2016.

Evli’s crossover strategy encompasses a broad, less-constrained investment universe, consisting of Euro IG, HY, and (Nordic) unrated bonds, which makes it possible to reduce risk while keeping the returns high. The strategy actively utilizes the movability of corporate bonds between different credit ratings. And these three asset classes have a fairly low correlation with each other.

Evli is a pioneer in both the European crossover and the Nordic credit markets. We consider both to be our home turf. Our proven track record makes us well-known and trusted. Our approach to combine European IG, HY and Nordic issues in distinct funds is still quite unique in a pan-European context. This approach allows our investors to participate in diversified, balanced and unconstrained portfolios that perform.

MSc (Econ), Chief Investment Officer at Evli. Mikael has invested in the European High Yield market since it’s birth in 1999 and has been the portfolio manager of Evli Corporate Bond fund that was launched the same year and Evli European High Yield fund since launch. He holds a Morningstar Analyst Rating for his funds.

Interested in further reading? See our section on Nordic Bonds and download the white paper The Nordic Corporate Bond Market.