Disclaimer

This publication is intended only for the client's personal and private use. This report is based on sources that Evli Bank Plc considers correct and reliable. However, neither Evli Bank Plc nor its employees give any guarantee concerning the correctness, accuracy or completeness of any information, views, opinions, estimates or forecasts presented in this review, nor are they liable for any damage caused by the use of this publication. Evli Bank is not responsible for any material or information produced or published by a third party that may be contained in this review. The information provided in the review is not intended as investment advice, or as a solicitation to buy or sell financial instruments.

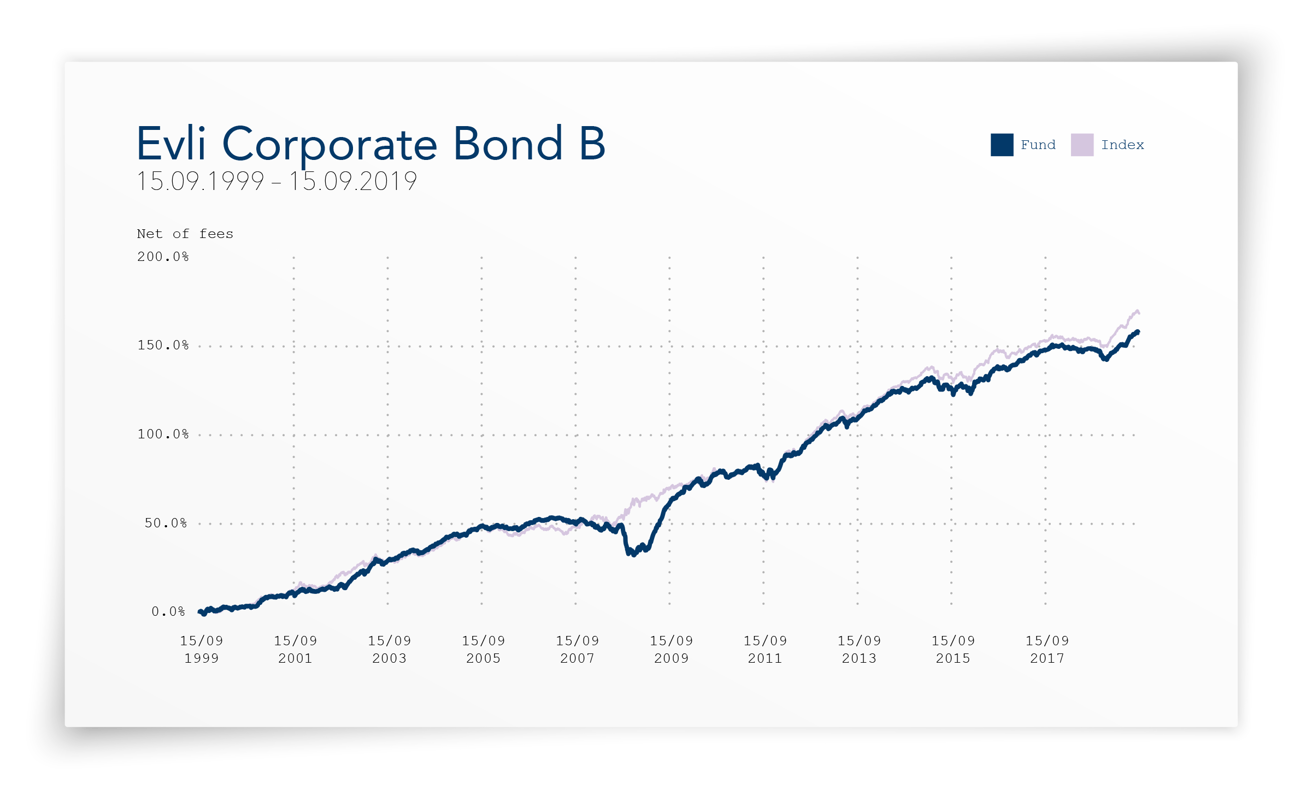

Past performance is no guarantee of future returns. This publication may not be copied, distributed, or published in the USA, and it is not intended for citizens of the USA. This material is not intended for persons resident in countries where the activities carried out by Evli Bank Plc have not been authorized by law.

This publication, or any part thereof, may not be copied, distributed or published in any form without Evli Bank Plc's written, advance consent. All rights reserved.

Morningstar Awards 2018 (c). Morningstar, Inc. All Rights Reserved. Evli Corporate Bond Fund managed by Mikael Lundström and Jani Kurppa received a Morningstar Award reward in 2018 and was chosen as the best EUR Bond Fund in Finland, France and Spain