The past year has been an extraordinary one for investors. Astonishingly, while the global economy was basically falling off a cliff 12 months ago – amid the coronavirus pandemic – central banks and other policymakers were surprisingly vigilant.

To the rescue, of both economies and markets, came lifeboats full of stimulus. The lifeboats were humongous: an aggregate of more than $20 trillion (20 000 000 000 000) of monetary and fiscal stimulus supported the recovery out of the great covid-19 recession (GCR) in 2020. What appears to be the deepest recession in post-war history, the GCR seems to end up also being one of the shortest ones. An exogenous shock-type of recession, the corona crisis has been devastating when it comes to human losses and other social problems.

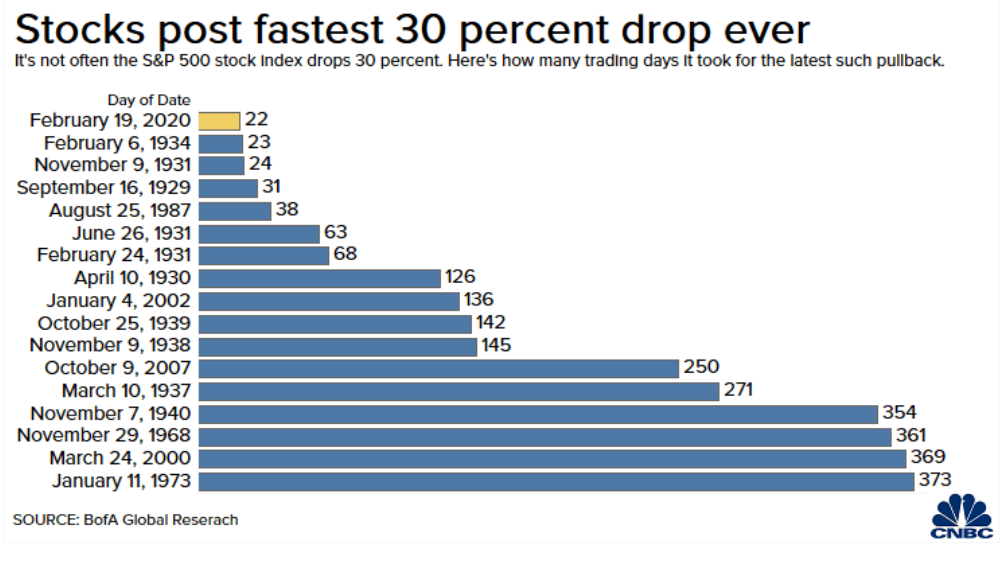

Source: CNBC

Source: CNBC

Although economic losses are still being repaired, the cost for financial markets has been surprisingly moderate. The stock market crash was quick and severe and lasted only for one month and two days! Fast forward to today, equity markets are making new all-time highs again. Liquidity measured by money supply is growing at a quick pace. Indeed, central banks are still buying loads of assets, mainly bonds, and are probably years away from raising their close to zero (or even negative) policy rates.

The great reflation

Indeed, there are good reasons to make a valid case for a continued rise in equity markets in 2021. The reflationary environment of 2021 will help drive risky asset prices higher.

First, the global business cycle is moving into an expansionary phase this year, after spending most of the time in a recovery since April last year. Naturally, we need to see a reopening of economies in the early spring as the virus wave further recedes.

Second, many countries around the world are still planning to add more fiscal stimulus. For instance, the US administration is planning a close to $2 trillion fiscal plan in early 2021. Also, the EU is releasing its €750 billion recovery fund this year.

Third, equities still offer a decent risk premium. That is, even though the absolute valuations are getting precious, the relative ones are still attractive.

Rotation, rotation, rotation

The regime change in financial markets may put forward several rotations. At times of change, market themes that worked over the previous years will start to crack – while new themes will take over the market leadership. Higher bond yields could be become one of the most exciting regime changes for a while. For example, in equity markets, there are interesting rotations now occurring that will get further support from the rise in bond yields.

Furthermore, investors will also continue to move away from expensive fixed income assets, such as government bonds. Instead, equities and higher carry bonds like high yield will keep on benefiting from this bullish rotation. Also, alternative asset classes such as private equity and infrastructure will continue to see positive money flows.

As central banks are still set to hold the short-term interest rates low for years, the long-term bond yields could rise much more than markets expect. It is always dangerous to tout such a major macro theme, with the hindsight of the several times over the past years when many investors (including us) thought that now was the major bottom in bond yields. But the case for higher yields could not be any stronger than now. Historically, when such a massive liquidity boost has occurred as over the past year, it has almost always raised price pressures. Yes, inflation could be the biggest macro risk over the next cycle. Especially in the US. And it would likely spill over to other countries as well.