After the economic downturn, some heavily levered Nordic sectors were practically left for dead. Now it’s time for a comeback.

Marketing material

After rebounding from COVID-19 much the same as risk markets globally, the Nordics suffered a setback when aggressive central bank rate hikes coincided with higher inflation, Chinese economic slowdown, and war in Europe. Equity markets in Sweden and Finland slid 30%, and high-yield credit spreads widened 300–400bps. After enjoying the luxury of near-zero financing for a decade and a half, levered sectors faced a new reality.

Chief among them was Swedish real estate, where investors had been playing with fire using excess leverage. Suddenly, the sector was virtually left for dead, not unlike the sensational hacker-cum-investigator Lisbeth Salander in the iconic Millennium trilogy by Stieg Larsson. In the Nordic Noir classic The Girl Who Played with Fire, Lisbeth is shot and buried by her adversary, and the audience is left holding their breaths and hoping for a miraculous escape.

Back from the dead

The aftermath of the setback was grim. Quick-footed international capital fled, currencies (SEK, NOK) weakened some 5 to 10% from already historically low levels, and prices adjusted. Economic activity (GDP) ground to a halt and even fell back in some cases. Growth was a mere mirage in the distance.

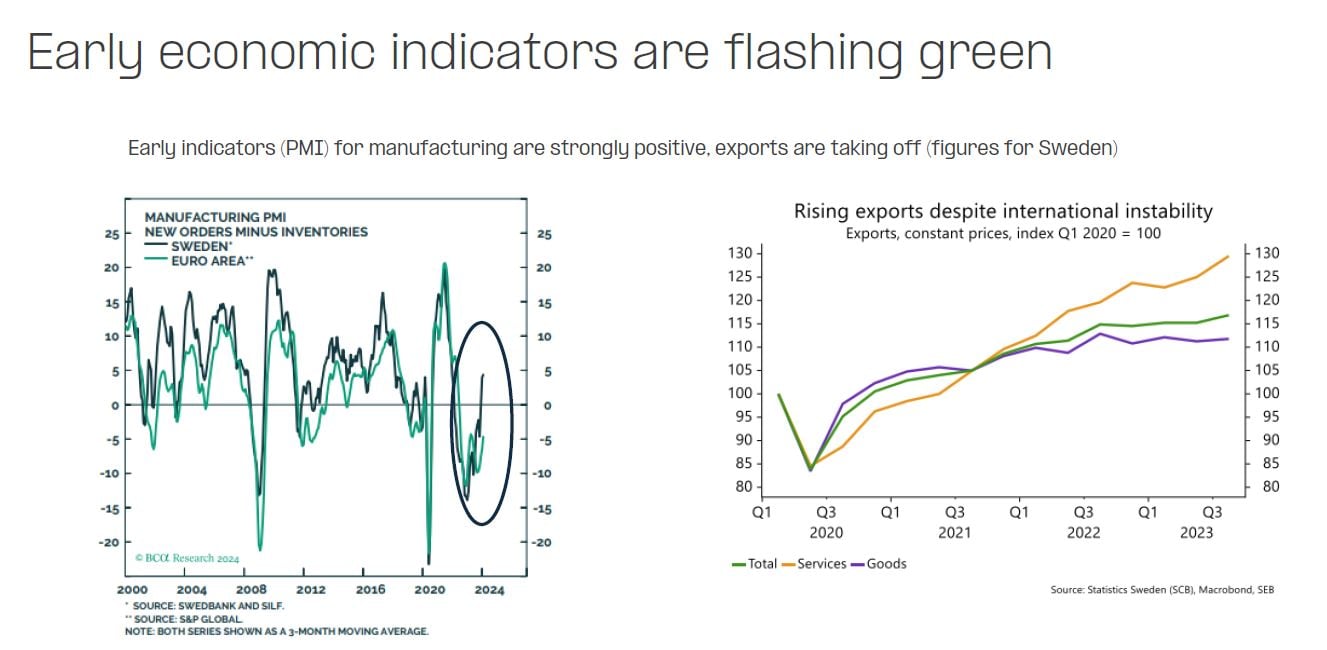

In 2023, there was little to cheer about in the Nordic economic numbers. But in the year’s second half, the first green shoots of recovery started to show, and by year end, the turnaround was a fact.

As we move deeper into 2024, the momentum is accelerating. Like the refusing-to-die Lisbeth Salander, Swedish real estate bonds have clawed out of their grave and are now rallying in a screaming comeback!

One of Larsson’s inspirations for Lisbeth’s character was another resourceful Nordic icon, Pippi Longstocking. Perhaps something in the Nordic mindset makes people – or companies and sectors – power through adversities and show the world that the small can be mighty. Nordic corporates have always overcome whatever the business cycle has thrown at them and recovered, often in spectacular fashion. Witness the Swedish banks, Nokia, Ericsson in the first half to the 90s, Lego in the 00s – the examples are numerous. Whilst there has been the odd casualty, the stellar successes are manifold in comparison.

Earnings momentum is accelerating

At the bottom of this blog post, you can find our Talking Points for April 2024. The document is Evli’s International Team’s outlook on the current opportunities in the Nordic markets. In this edition, we focus on the outlook for Nordic credit. Here are some key findings:

- As is their prerogative, the financial markets anticipated the change in economic progress and central bank policy. When rates stabilized, rate-cut expectations crept in, making 2023 a banner year for Nordic credit. The result was high single-digit returns above the benchmark for Evli’s credit funds, with high yield racking up double digits and the ultra-short Evli Liquidity almost 5%. 2024 has started in a similar fashion, with the whole product range leaving their benchmarks a shrinking image in the rearview mirror.

- Given the higher interest rates and the yield-to-maturities, the expected returns of Evli fixed-income funds remain at historically attractive levels (4 to 7%, with Evli Leveraged Loans offering almost 9%).

- Evli’s Fixed–Income Funds – naturally Evli Nordic Corporate Bond (ISIN FI0008812011) but also Evli Short Corporate Bond (ISIN FI4000233242) and Evli Leveraged Loan (ISIN FI4000507264) – have a strong Nordic bias and will enjoy the extra boost from the regional overweight. The first quarter of 2024 is tracking strongly and heading towards equity-like returns in the high single digits (with slightly less for the ultra-short duration products). On risk-adjusted terms, this spells best in class.

Despite bleak settings and grim events, Nordic Noir usually ends with the protagonist victorious. With historically healthy balance sheets and accelerating corporate earnings momentum, the Nordic region is now exiting recession and hitting the ground running.

Your team of detectives, aka Evli’s International Team

This year (Nov 9th) will mark the 20th anniversary of Stieg Larsson’s premature passing. Rest in peace, Maestro.

See above slide and further in depth info about the positive Nordic economic environment here.