The year 2023 saw a mixed economic performance, with the US recovering from a slump, Europe slipping into negative growth, and China facing a slowdown and a real estate crisis. The financial markets experienced volatility and shocks, but ended the year on a positive note, as inflation fears eased and earnings growth remained resilient. What to expect from the Nordics in 2024?

We highlight five key issues: 1. a positive growth and inflation outlook, 2. mild implications of China trade and deglobalization, 3. real estate markets musing the outlook, solid corporate credits and just singular defaults, 4. the tackling of political and structural issues and 5. a positive capital market outlook.

1. Positive growth and inflation outlook

Our overall global economic growth scenario is positive. The United States is expected to avoid a recession next year, with economic growth driven by high employment and wage growth. Europe is likely in a mild recession, with recovery dependent on consumer confidence and industrial rebound. High connections to China's economy, industrial weight, sensitivity to energy prices, and high savings rates contribute to economic challenges. China's economic growth has slowed to 4-5 percent, marked by the end of the real estate boom. Structural changes, such as reduced stimulus, indicate a more conservative economic approach. China's government is less inclined toward significant stimulus measures, indicating a shift from the massive stimulus used during economic downturns in the past.

Despite the baseline scenario not predicting a recession next year, it can’t be ruled out due to higher interest rates historically linked to recession in two out of three cases. High interest rates impact different European economies differently, with Spain, Italy, and Finland experiencing rapid rises in home loan rates, while Germany and France maintain historically low rates. Inflation has decreased faster than expected, but there is a risk of prolonged service inflation due to rapid wage inflation, potentially keeping interest rates higher for an extended period.

Also uncertainties such as geopolitical events and changing economic dynamics pose risks to this outlook. The U.S. presidential election in November 2024 is a significant geopolitical event. Donald Trump is a front-runner, and the markets may react differently to known factors compared to his previous election. The markets initially rose after his previous victory in 2017, but the impact of his policies remains uncertain.

Avoiding any shocks, the global growth slowdown will tamper out as continued global demand ramps up production and inventory build-up. The pick-up benefit cyclical and export oriented Nordic countries. Easing financing conditions also ameliorate corporate and household refinancing.

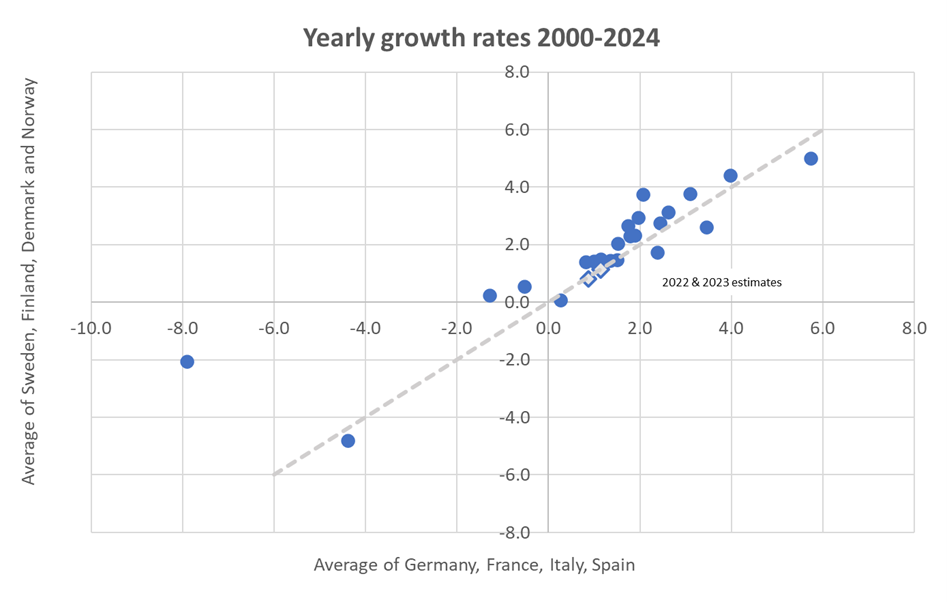

The Nordic countries average GDP growth is 0.6 percent higher than the average of Euro big 4 countries’ during years 2000-2024

Y-o-y % change of gross domestic product, constant prices

Years 2022 and after are IMF estimates

Source: International Monetary Fund, World Economic Outlook Database, October 2023

2. China trade and deglobalization have mild implications

Exports account for about one-third of Sweden’s GDP. The emphasis has shifted from export of raw materials and semi manufactured products (pulp, steel, sawn wood) to finished goods, dominated by engineering products (cars, telecommunications equipment, hydroelectric power plant equipment) and, increasingly, high technology and chemical- and biotechnology. China is the 8th largest export market with a 5.2 percent share. (Source: Encyclopedia Britannica).

Imports are more diversified than exports. Before the 1980s petroleum was the single most important import, accounting for more than one-fourth of the total value. In 1990 petroleum accounted for less than 5 percent of the total. Almost half comes from the import of engineering products (including motor vehicles, business machines, and computer equipment). Among the imported foodstuffs are coffee, tea, fruit, and fish. Chemicals and textiles are other groups of imported goods. China’s share of Sweden’s imports is 6.3 percent and ranks 5th.

Although traditional exports of paper, paper products and wood products remain important, heavy machinery and manufactured products now constitute the largest share of Finland’s export trade. Imports consist mainly of raw materials for industrial use, consumer goods, and mineral fuels. China’s share of Finland’s exports is 6.3 percent (5th) and of imports is 5.8 percent (5th) *.

Foreign trade, in the form of commodities exported mainly to western Europe or shipping services throughout the world, accounts for more than two-fifths of Norway’s national income. Norway’s booming petroleum industry has ensured a strong positive balance of payments for the national economy, despite some declines in the manufacturing and agricultural sectors. The great majority of Norway’s petroleum exports go to the nations of the European Union. Other important exports are machinery and transport equipment, metals and metal products, and fish. Principal imports include machinery, motor vehicles, ships, iron and steel, chemicals and chemical products, and food products, especially fruits and vegetables. China’s share of Norway’s exports is 6.5 percent (5th) and of imports is 7.6 percent (3rd).

In the late 20th century Denmark’s overseas trade pattern shifted to a major reliance on the export of industrial products, including industrial machinery, electronic equipment, and chemical products. These goods — along with fish, dairy products, meat, petroleum, and natural gas — remained important exports into the early 21st century. Denmark also has created an export market for household furniture, toys, silverware, ceramics, plastics, textiles, clothing, and other goods notable for their creative modern design. China’s share of Denmark’s exports is 5.1 percent (7th) and of imports is 8.8 percent (3rd).

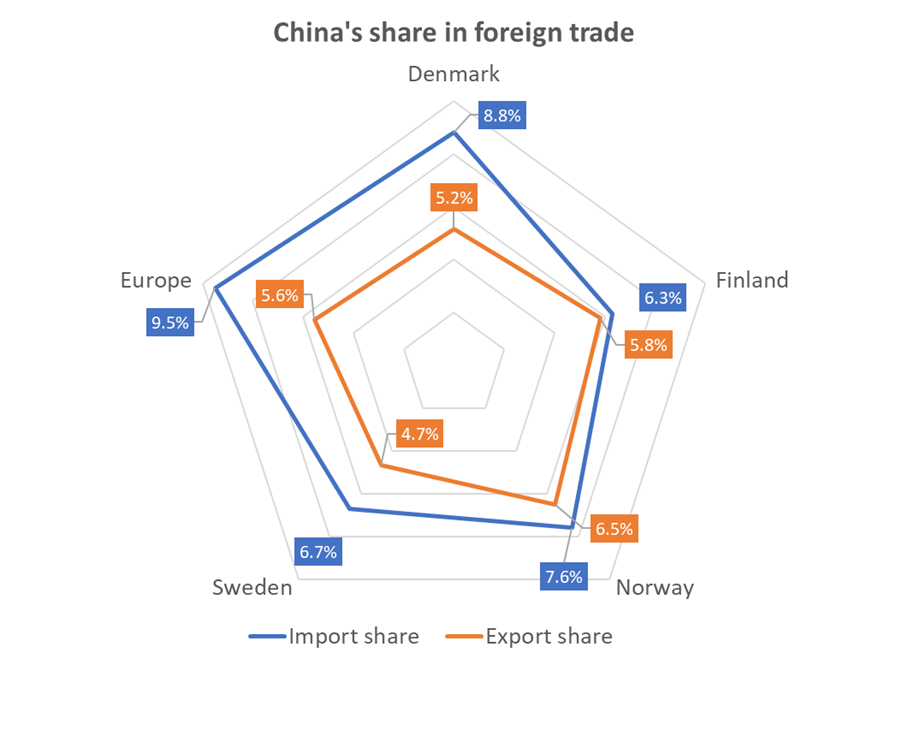

Germany is the most important trading partner for Denmark, Finland and Sweden and the second largest for Norway. In comparison China’s share of UK’s imports is 13.1 percent (1st) of UK’s exports 5.2 percent (7th). China’s share of Europe’s (EU28) imports is 9.5 percent (2nd) of exports 5.6 percent (4th).

China's share of imports of the Nordic countries is lower than of Europe in average. The share of export varies, but trade with China is more balanced in Finland and Norway.

Data as of year 2021. Among the 30 largest Nordic companies, the highest revenue exposures to China (Refinitiv database and company sources, as of 2022) are with Kone 31%, Atlas Copco 23%, ABB 16% AstraZeneca 13%, UPM-Kymmene 10% and Novo Nordisk 9%. Banks and financial companies don’t have or don’t report exposures to China and the median exposure is 6 percent.

Data as of year 2021. Among the 30 largest Nordic companies, the highest revenue exposures to China (Refinitiv database and company sources, as of 2022) are with Kone 31%, Atlas Copco 23%, ABB 16% AstraZeneca 13%, UPM-Kymmene 10% and Novo Nordisk 9%. Banks and financial companies don’t have or don’t report exposures to China and the median exposure is 6 percent.

Source: The Atlas of Economic Complexity

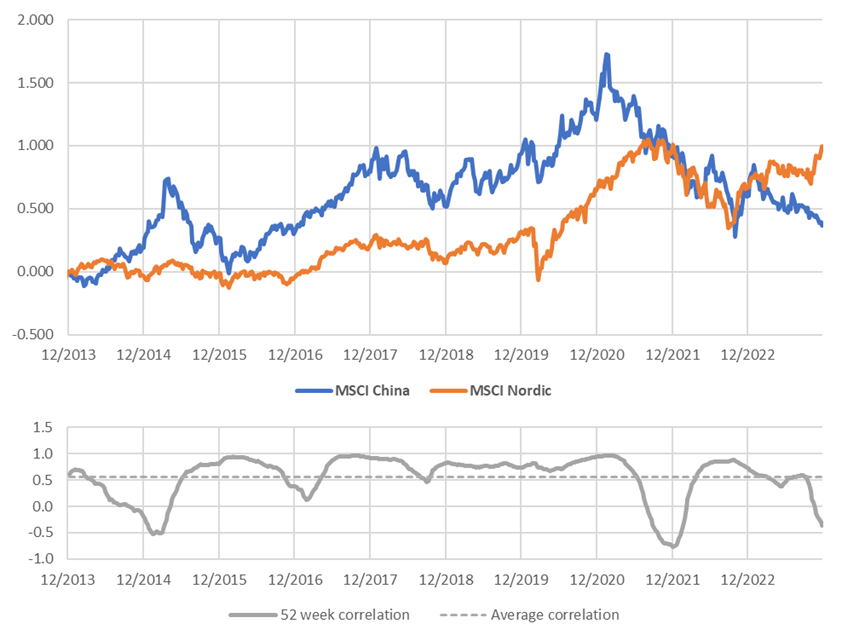

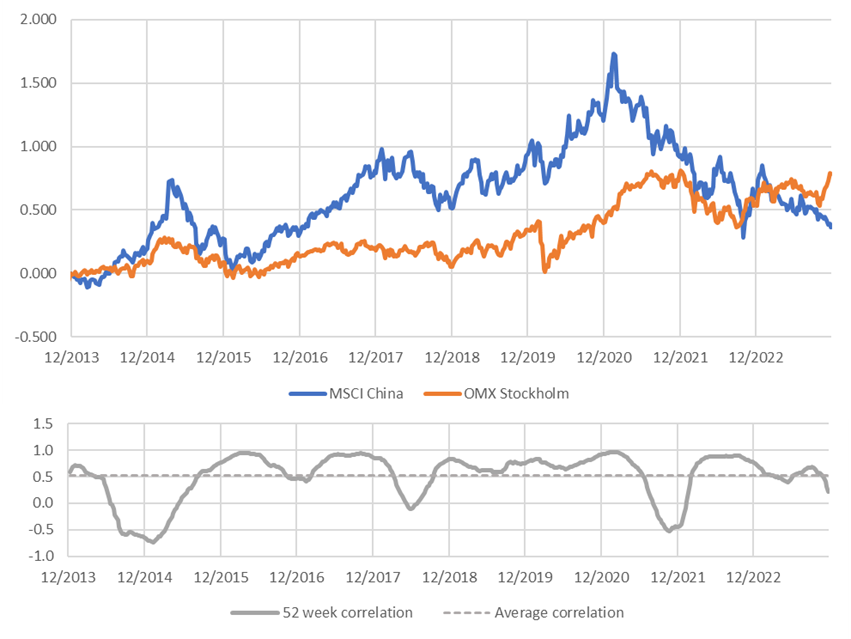

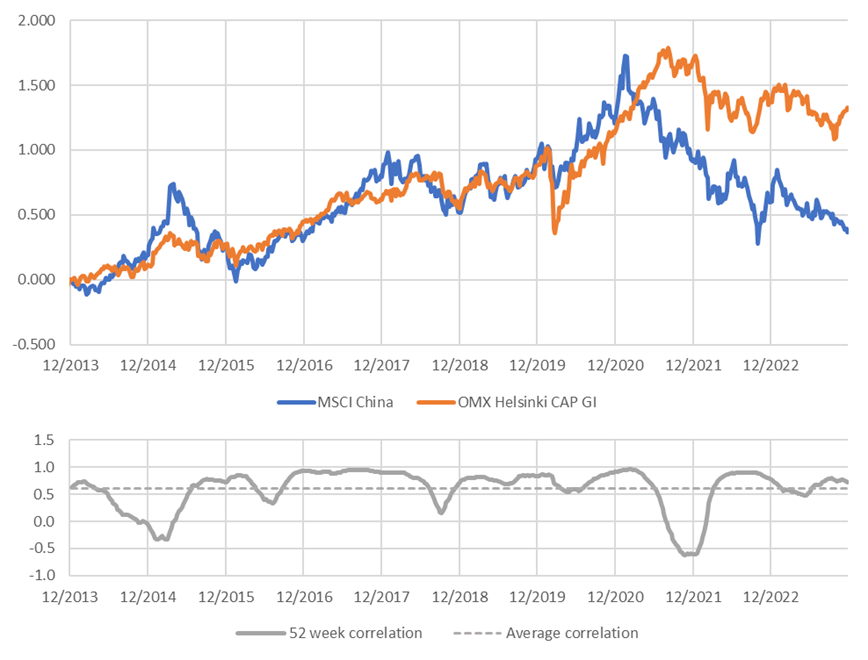

The correlations of Nordic equity markets to MSCI China are on average 0.5 – 0.6. The rise in correlations in 2022 have reversed as the Nordic markets are decoupling from the developments in China.

The performance of MSCI China and MSCI Nordic indices and their rolling 52 week correlation

Data: LSEG Refinitiv

Data: LSEG Refinitiv

The performance of MSCI China and OMX Stockholm indices and their rolling 52 week correlation

Data: LSEG Refinitiv

Data: LSEG Refinitiv

The performance of MSCI China and MSCI Helsinki indices and their rolling 52 week correlation

* Trade with Russia has stopped in 2022 representing 11,9 percent of Finland’s imports (mainly crude oil) and 5,0 percent of exports.

Data: LSEG Refinitiv

3. Real estate markets muse, corporate credits are solid and eventual defaults singular

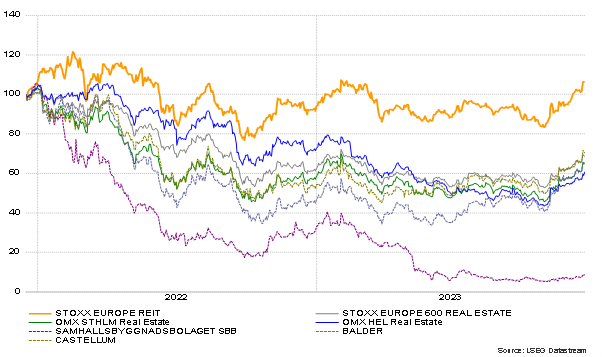

The real estate sector in the Nordics is adapting to a higher interest rate environment. Credit quality is pressured by leverage, declining asset values and upcoming refinancing needs. Valuation headwinds, refinancing needs, and soft economic growth maintains investor caution. Nevertheless, with inflation and interest rates easing, refinancing returns to more normal levels.

Good operating performance and inflation-linked rent increases have sustained rental growth, but hardly enough to offset rising capital costs. Property valuations have been dominated by higher yield requirements, which has only been partially offset by rent indexation. For credit quality to stabilise, companies continue to deleverage their balance sheets by raising equity, divesting assets, and curtailing capital spending and dividends.

Equity prices of real estate companies are recovering

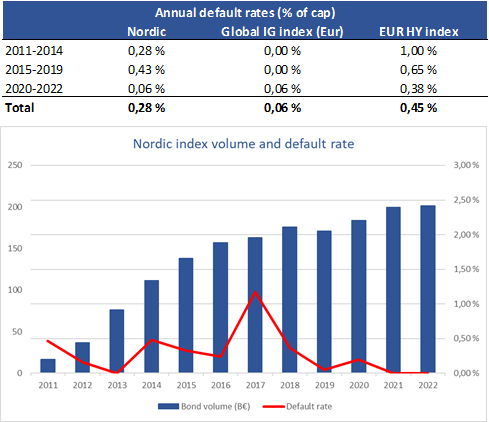

Nordic companies have weathered well the economic slowdown. Default rates are at record lows. Some casualties might occur, but unlikely at large scale. The banking sector is also solid. Although credit losses are expected to increase, the banks are likely to show historically high operating profits in 2024-2025. So far reported credit losses have been lower than expected. Credit losses for the big four banks averaged 0.04 percent in H1 2023. The EBA’s 2023 Stress test confirmed the Nordic and Swedish banks resilience, despite the use of a more severe stress scenario than the EU average.

Nordic Corporate Bond Market Defaults 2010-2022

Source: Stamdata, Bloomberg. Asset class: Bonds (active and matured). Amount issued: Min 30 M€. Industries: Excludes Sovereigns/Governments/Public. Country (of domiciliation): DK, FI, SE, NO. Currency: EUR, DKK, NOK, SEK, USD. Initial maturity: Over 18 months. Bond maturity: No perpetuals (99+ years)

4. Tackling political and structural issues

Major political developments in the Nordic countries are the rising anti-immigration attitudes and the NATO memberships of Finland and Sweden.

Anti-immigrational policies are not a new phenomena, but the recent increase in homicides and violence in Sweden are in many cases tied to foreigners or immigrants. It has raised concerns among business leaders and is harming the Swedish reputation. The development of immigration in the Nordic countries, and in the EU as well, attached with potential foreign influence, could increase security concerns and strengthen nationalistic factions.

At the same token, the demographic development is leading to a decrease in the labor forces. This isn’t unique for the Nordic countries either. The important issues are keeping the economic competitiveness, reforming labor markets and public finances.

Public finances are in good shape. Finland’s debt has increased somewhat, but it’s still under the average of euro countries and the new government is aiming to reduce public debt.

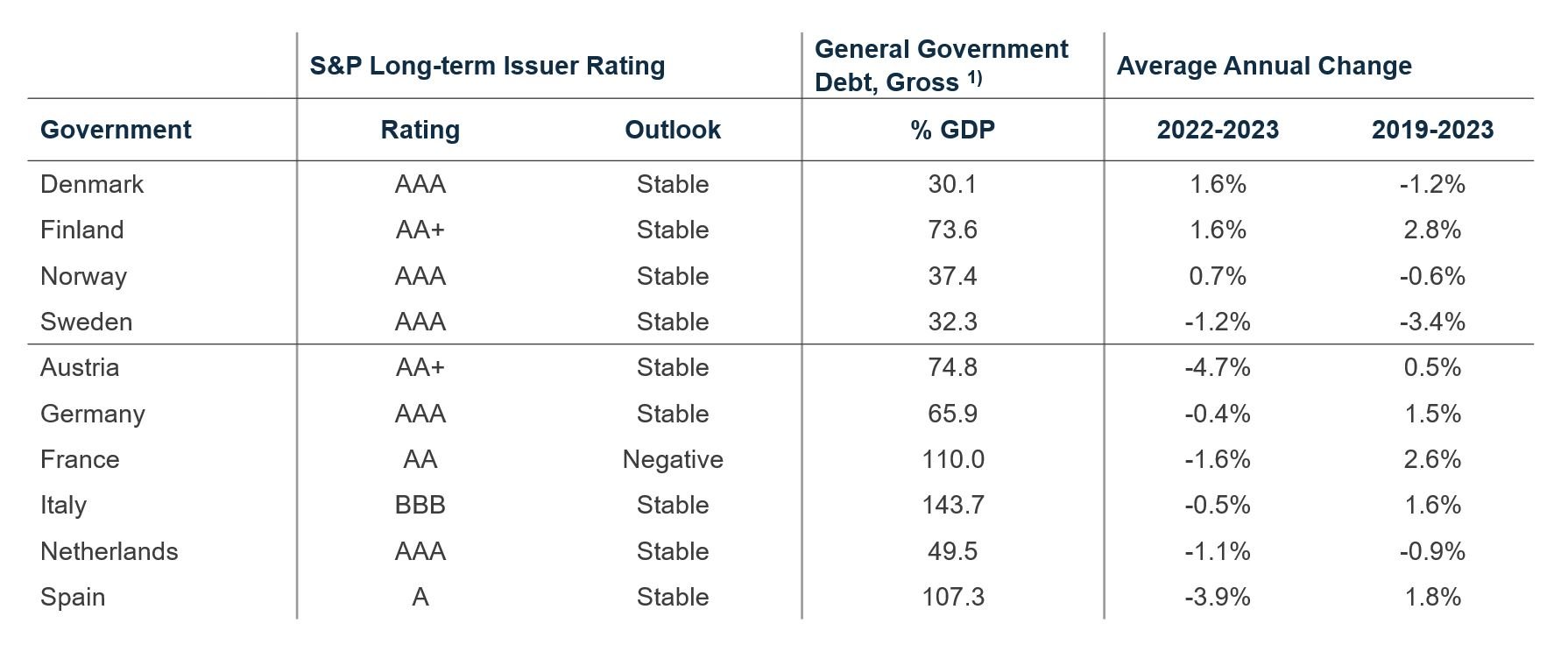

Government debt and issuer rating in selected countries (click to enlarge image)

Source: IMF, Standard & Poor’s

5. Capital market outlooks for 2024

The global shift in central bank rate expectations is also seen in the Nordic markets. Six month forward rates imply the Danish central bank cutting by more than 100 basis points (bps), the Riksbank cutting by more than 150 bps and the Norges Bank cutting in line with the ECB 75-85 bps. The central banks can move rapidly thanks to consumer prices declining even faster than in the euro area.

The Swedish and Norwegian krones are close to their weakest levels against the euro ever and have thus much potential for appreciation, especially should the euro/dollar rate strengthen.

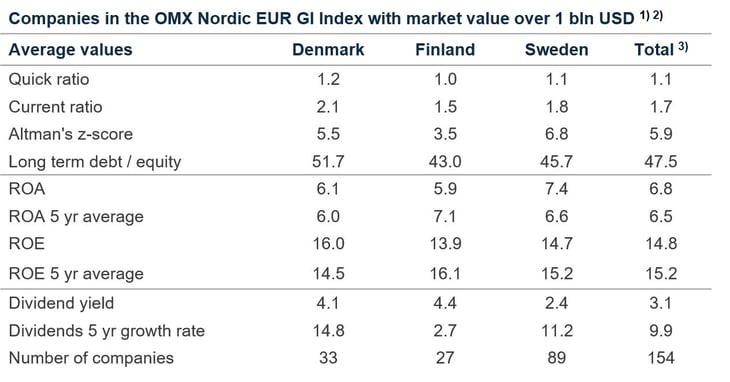

Corporate health is good in the Nordic markets. Leverage, credit quality and profitability measures are at good levels. In our base case scenario for 2024, the Nordic companies are well positioned to a rebound in the global economy.

Leverage, credit quality and profitability measures of Nordic companies (click to enlarge image)

1) Excluding financial and real estate companies

2) The companies have a total market value of 1,0 trn USD and represent 95 percent of the index

3) Total number includes 5 unlisted companies

Source: LSEG Refinitiv, OMX

The Finnish equity market has a very cheap valuation relative to the past 10 years. The Danish market on the other hand is expensive, thanks to Novo Nordisk.

Nordic equity markets are cheap, except for Denmark (click to enlarge image)

Source: LSEG Refinitiv, OMX

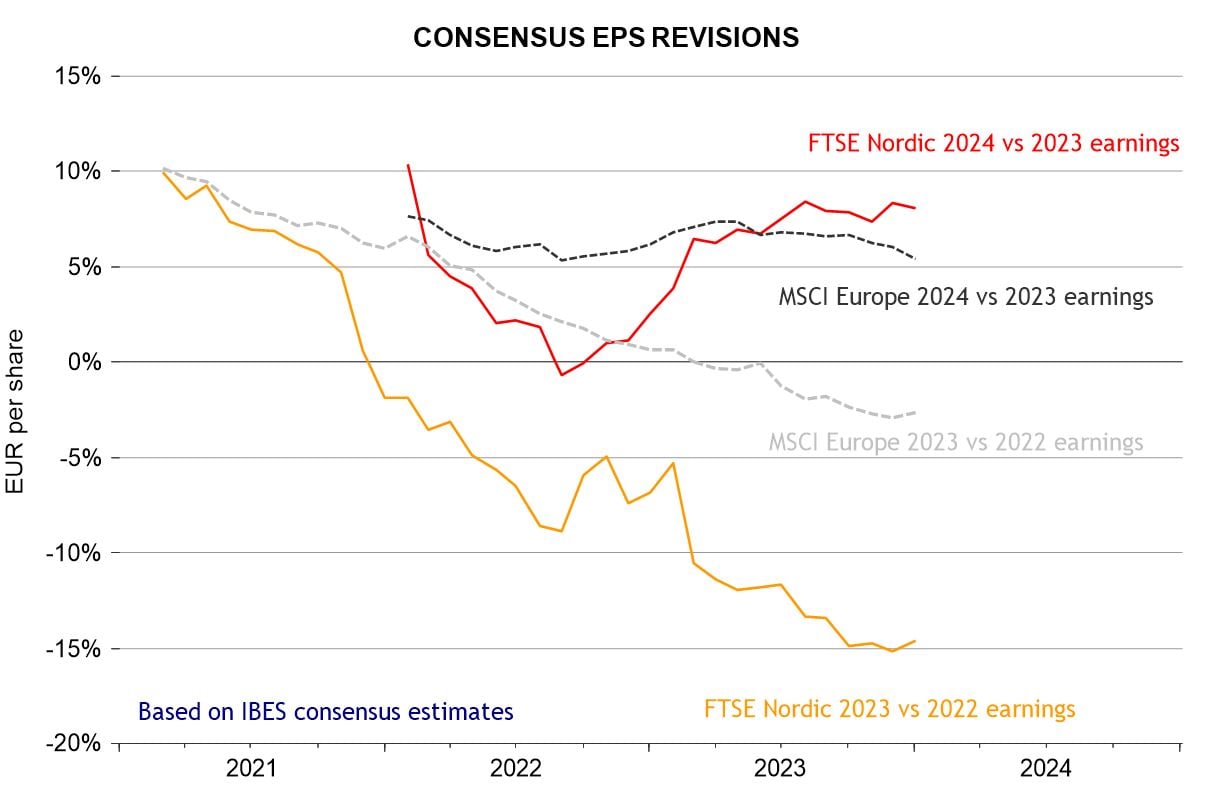

As a whole, Nordic companies earnings revisions have turned up after a dismal past year. Swedish and Finnish industrials and export companies should get a boost from a recovery in the global demand during 2024.

Source: LSEG Datastream