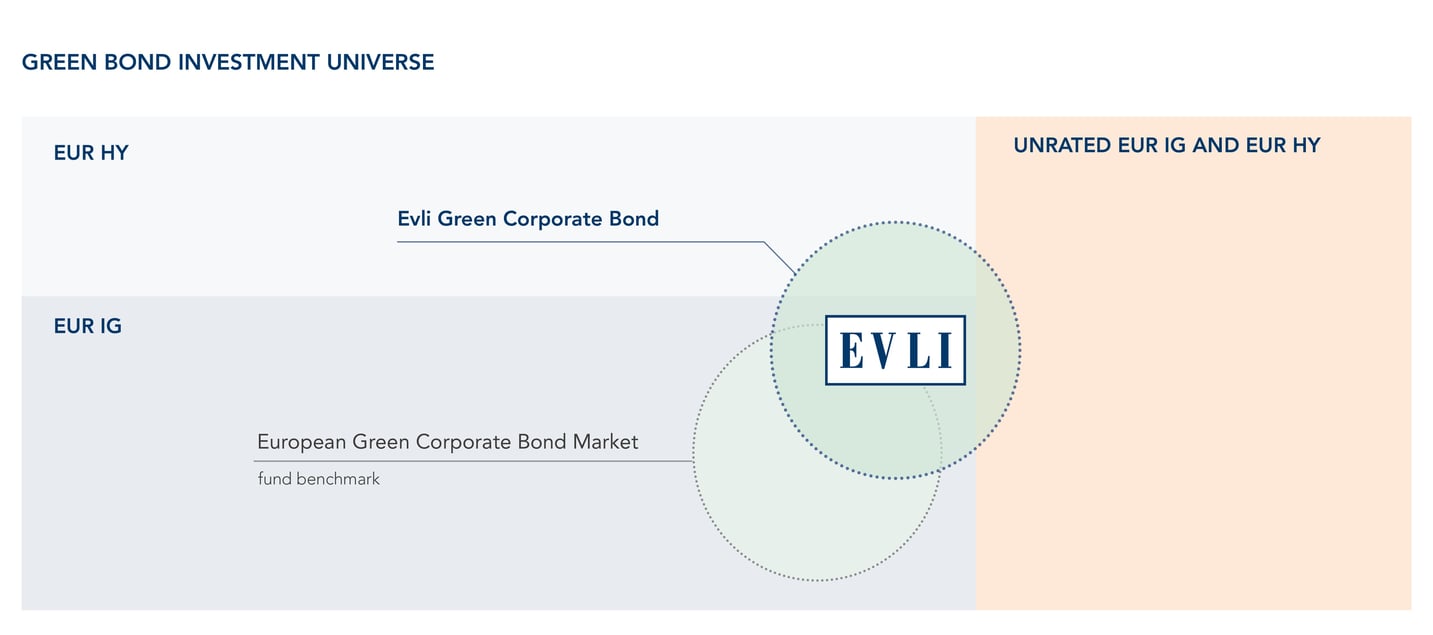

Genuinely Green Corporate Bonds from a broad investment universe. Offers the same credit risk as traditional bonds while supporting the transition to a more sustainable economy.

YTM: Yield To Maturity

Investment Grade (IG) bonds typically have a lower risk and a higher credit rating (AAA-BBB), High Yield (HY) bonds typically a higher risk and a lower credit rating (BB-D). AAA is highest on the rating scale used by major rating agencies and D lowest.

As at September 30, 2020

*Bloomberg Barclays MSCI Euro Corporate Green Bond 5% Capped Index

Green corporate bonds are growing in popularity, but it can be tricky to figure out just how green these investments really are. How do you know when ‘green’ is really green and not just a catchy name of the bond?

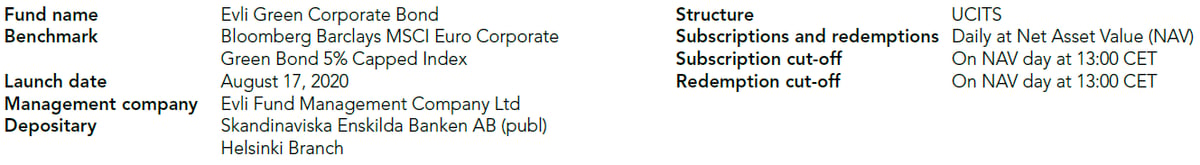

Read moreThe Evli Green Corporate Bond fund is managed by Juhamatti Pukka, Head of Fixed Income at Evli and manager of the Evli Short Corporate Bond fund. Noora Lakkonen, Credit Analyst, ESG and green bonds, and in charge of monitoring ESG factors for Evli’s corporate bond strategies, is responsible for the green bond analysis of the fund.

EN Key Investor Information Document B-series

EN Key Investor Information Document IB-series

DE Wesentliche Anlegerinformationen B-series

DE Wesentliche Anlegerinformationen IB-series

ES Datos fundamentales para el inversor B-series

ES Datos fundamentales para el inversor IB-series

FR Informations clés pour l'investisseur B-series

FR Informations clés pour l'investisseur IB-series

IT Documento contenente le informazioni chiave per gli investitori B-series

IT Documento contenente le informazioni chiave per gli investitori IB-series

This material is considered as marketing material for the fund. Prior making any investment decision, the investor should familiarise with the fund rules, prospectus, key investor information document and other statutory documents of the fund. Nothing contained on this site constitutes investment advice or recommendation.

Past performance is not a guarantee for future results. Investments in funds can increase as well as decrease in value because of market fluctuations, the fund’s risk profile or costs related to subscription, redemption, management fees etc., and the investor may lose the full amount invested.

No representation is made that the estimates, data or information herein is complete, and the information can be subject to change without notice..

Fund rules, Key Investor Information Document, brochures and other information material are available at www.evli.com/greenbond

From Lipper Fund Awards from Refinitiv, ©2022 Refinitiv. All rights reserved. Used under license.

As the value of mutual funds may rise or fall, it is not certain that you will always get back the invested assets. Past performance is not a guarantee of future returns.

×