This phrase was coined in 1952 by Nobel Prize winner Harry Markowitz, one of the grandfathers of modern portfolio theory. 65 years later, diversification is still not first on the list, as investors pay surprisingly little attention how to diversify their portfolio efficiently. Furthermore, investors are not nearly as diversified as they think they are.

An efficient diversification scheme built in to your investment process can enhance returns and reduce risk in your portfolio over the long-term. Hence, the diversification method can be as important as your overall investment strategy when it comes to return contribution. At its best, a truly efficient diversification also improves the risk management of the portfolio.

Factors and diversification

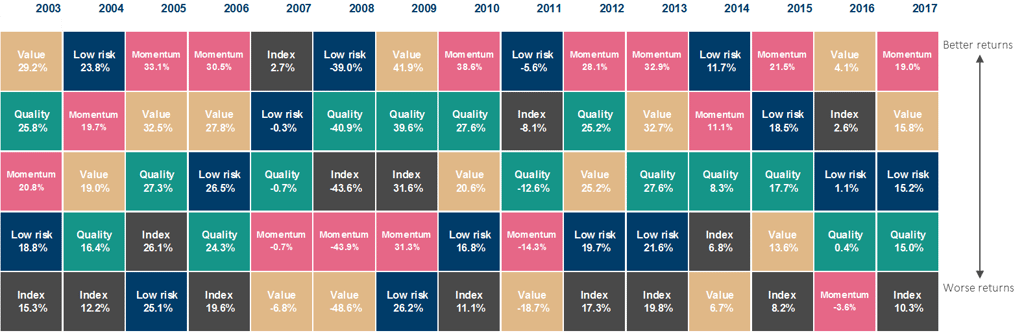

Factors are regarded as alternative sources of return and risk, as opposed to traditional asset classes. Similar to asset classes, factor returns can be very cyclical. In other words, factor premiums vary over time and may exhibit skewness risk and large negative returns over certain time periods.

Diversifying between rewarded factors seems sensible in many ways. First, factor returns are often uncorrelated or even negatively correlated. Even though factors offer excess returns in different market conditions, a factor can significantly underperform the market over a shorter span. Moreover, the yearly returns can vary significantly among factors. A good example is the usually negative correlation between value and momentum stocks. Therefore, combining many factors makes sense.

Chart 1: Factor returns vary in different market conditions

Click the image below to enlargenSource: Scientific Beta, Bloomberg, Evli (table shows European factor returns & MSCI Europe TR Index)

Second, many factors embed some type of risk, like large drawdowns in bad economic times that investors get compensated for over the long-term. Some factors seem to be driven by investor behavior and mispricing in the market that better explain the factor premia. These theoretical explanations also support the notion that diversifying between factors improves risk-adjusted returns.

Finally, there seems to be a largely consensual view in academic research, in line with our own assessment, that future factor returns are hard to predict. Put it differently, it is very hard to time factors. Even in this respect, an objective and broadly diversified multi-factor approach will enhance portfolio returns and decrease risks.

Diversifying your equity factor portfolio

In equity factor portfolios – diversification among securities is crucial – as one of the objectives is to minimize idiosyncratic risks, or security-specific risks. Equity factor investors want to be exposed to rewarded factors, not individual security risk.

Long-only investors have been pouring money into market-cap weighted index funds and ETFs over the past years. Such investment vehicles are usually cost-efficient, but might be less efficient from a diversification perspective. Market indices tend to have large weights in mega-cap stocks and are not as well diversified as one might expect. These indices are also exposed to unrewarded risks like expensive growth stocks, which might do well in the short-term, but have been shown to underperform over the long-term.

One objective of the long-term investor should be to avoid concentration risk. Even by simply equally weighting your stock portfolio has been demonstrated to not only enhance the diversification, but also improve returns and decrease the overall risk. Other diversification techniques can also improve your diversification.

Combing an efficient diversification scheme to your factors enhances the return profile and can also reduce risk levels.

Chart 2: Combining factors and diversification

Enhancing portfolio diversification

Simple rules, a systematic process and a working diversification scheme can improve portfolio returns and reduce risks. Investors should pay more attention to diversification, regardless of the investment strategy.

Factor diversification makes most sense as correlations among factors tend to be low. But diversifying your stock portfolio is likewise important to be able to minimize security-specific risks.

The effectiveness of diversification can be measured in various ways. One useful gauge is the risk-adjusted return. Measured with for instance the Sharpe ratio or information ratio, the risk-adjusted return will improve with an efficient diversification strategy.

Interested in further reading? Download the white paper The Case For Equity Factors.