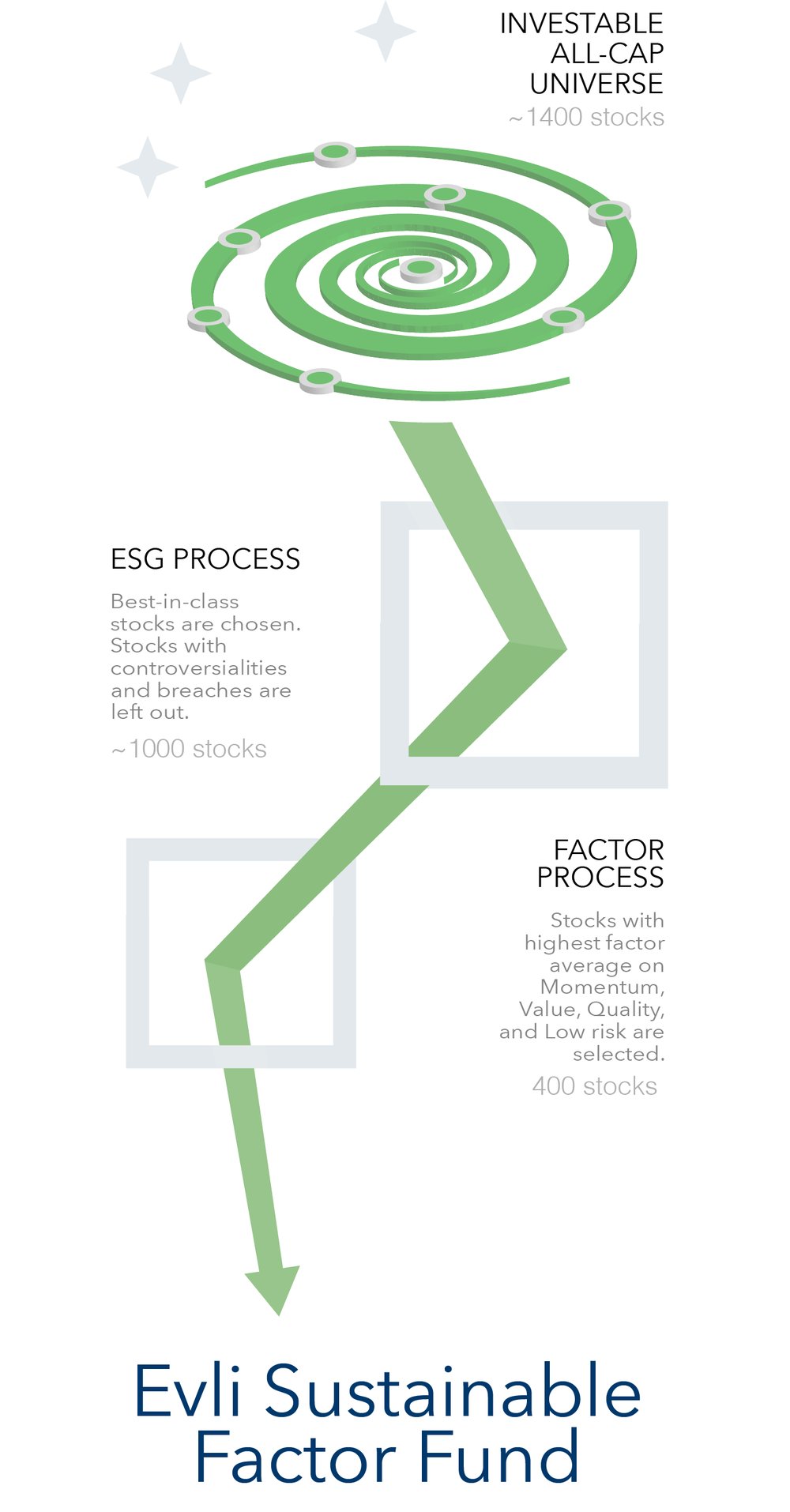

Return potential of active management combined with cost levels closer to passive management.

Factor portfolios offer better diversification than traditional market indices – less stock specific risk and broader diversification among large, mid and small caps.

Academic research shows robust evidence that factors offer high expected returns in the long run.

Factor funds have a lower total cost structure than traditional active management - resulting in higher net-of-fees performance.

Best-in-class ESG approach – investments only in most responsible companies.

•

Excluding companies producing alcohol, weapons, tobacco, gambling, adult entertainment and thermal coal.

•

Excluding companies violating UN Global Compact principles based on MSCI ESG as well as MSCI red flags excluded.

•

Quarterly ESG reports on responsibility, ratings and violations.

*Source: Evli, Bloomberg, Morningstar 31.5.2016-31.5.2019. As at 30.8.2019, Evli Equity Factor Europe holds a 4-star Morningstar rating for its 3-year performance.

The main risk is equity market risk.

•

Other risk factors are liquidity risk and management risk.

•

The investor is urged to view the Key Investor Information Document and the fund prospectus for a detailed view of the risks to which the fund is exposed.

Senior Portfolio Manager

Senior Portfolio Manager

Portfolio Manager

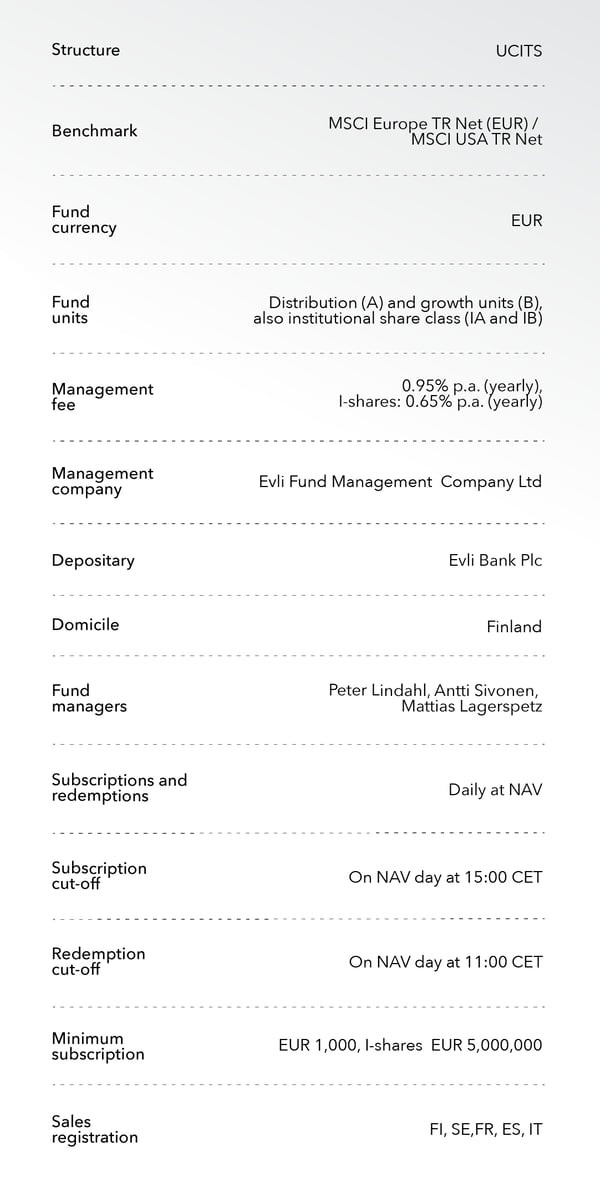

Evli Fund Management Company Ltd is a Nordic fund management boutique established in in 1989 focusing on institutional investors. Our investment process is systematic and characterized by both quantitative methods and qualitative assessments. Rigorous discipline ensures repeatability of the investment process. Our Funds are actively managed with a long-term perspective. On average, senior portfolio managers have worked at Evli for 10 years and have 20 years’ industry experience.

Evli Fund Management Company has an authorization to operate UCITS and alternative investment fund management (AIFM) activities in Finland and its operations are supervised by the Finnish Financial Supervisory Authority. Evli’s website is not intended for persons resident in countries where such activities have not been authorized by law. Evli requires that all persons accessing to site website familiarize themselves with these kinds of restrictions and comply with them. The contents on Evli’s webpages are for information only and cannot be in any case construed as an offer to sell or subscribe to any product in a jurisdiction in which the making of such an offer would be illegal.

The information in this site is intended for Professional Investors only and must not be used or relied upon by private investors. Please note that all information on this Site is available in English only.

1. Entities authorised to participate on the financial markets

2. Large undertakings meeting two of the following three requirements:

3. Countries, regions, national and regional authorities, public bodies that manage public debt, central banks and the European Central Bank, the World Bank, the International Monetary Fund and other similar international and supranational organisations,

4. Institutional investors other than those above whose main activity is to invest in financial instruments, including undertakings dedicated to securitizing of assets or other financial transactions.

By accessing this Site you agree to be bound by the following Terms and Conditions (pdf) as well as our Cookie and Privacy Policies.

DISCLAIMER

This material is intended as general information to the recipient. Nothing contained on this flyer constitutes investment advice, nor is it to be relied on, in an investment decision. The information is product-related information only, and it is not to be regarded as an investment recommendation. Evli recommends that you read the relevant fund prospectus and brochure(s) and contact a professional advisor in order to obtain relevant and specific personal advice, before making any investment decisions. No representation is made that the estimates, data or information herein is complete, and the information can be subject to change without notice.

Past performance is not a guarantee for future results. Investments in funds can increase as well as decrease in value because of market fluctuations, the fund’s risk profile or costs related to subscription, redemption, management fees etc., and the investor may lose the full amount invested.