Do you know what factors your portfolio holds?

Did you know that instead of breaking your equity portfolio down by investments, it can be divided into factors? A better understanding of what factors your portfolio holds gives you an enhanced view of the return drivers and the opportunity to replace weaker drivers by more efficient vehicles. Active funds might contain implicit factor exposures, so make sure you are not paying active fees for “disguised” factor investing. If all your returns from active funds are contributed by factors, perhaps you could use a factor fund instead.

We’re happy to help you gain insights of the factors present in your portfolio and offer you a free analysis of your holdings. All we need you to do is sign up and express your interest and we will get in touch to agree on next steps for a detailed breakdown of your investments.

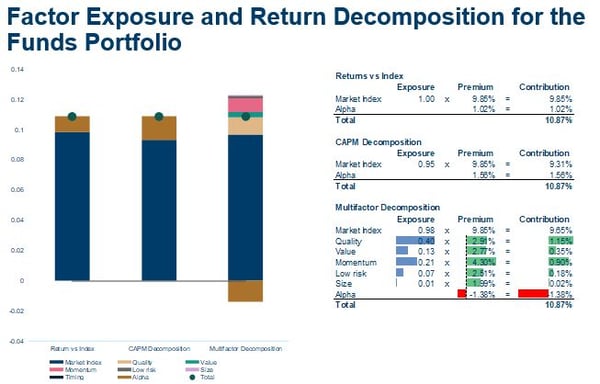

Example page of an analysis.

The analysis will be done based on your equity holdings (funds or etf). In order to do this we will need ISINs and weights of the holdings. The results will be summarised in a report and presented to you.

All information will be handled in confidence. The analysis is meant for institutional investors only.

Please do not hesitate to get in touch if you have any questions about the analysis or factor investing. Interested to find out more about factor investing? Visit our Funds Hub for more information.

Evli Fund Management Company Ltd is a Nordic fund management boutique with a prime focus on institutional investors. We offer bottom-up, active management focusing on free cash flow with a long time-perspective and active ESG approach.