Offering access to the unique Nordic corporate bond market, with a return expectation of 3% p.a. and deep ESG integration.

FUNDRAISING CLOSED

* Yearly return, net of fees. NB this does not constitute neither a promised return nor a commitment by Evli to achieve such returns. The Fund may incur the risk of loss of capital, as well as credit risk and the risk of investing in high-yield bonds

** Investment Grade (IG) bonds typically have a lower risk and a higher credit rating (AAA-BBB), High Yield (HY) bonds typically a higher risk and a lower credit rating (BB-D). AAA is highest on the rating scale used by major rating agencies and D lowest.

When it comes to cracking the Nordic Corporate Bond market, smart investors look for fund managers backed by years of experience with a quick, perceptive grasp of local markets. All qualities that make Evli a one-of-its-kind asset manager in the Nordics.

Read moreNordic 2025 Target Maturity fund is managed by Juhamatti Pukka - Head of Fixed Income at Evli and manager of the Evli Short Corporate Bond fund - and Jani Kurppa - Senior Portfolio Manager and manager of the Evli Nordic Corporate Bond fund. Einari Jalonen is the funds Credit Analyst.

• Main risk is credit risk, ie. that an individual bond issuer’s solvency may deteriorate, which could lead to price contraction or even default

• Other risk factors are liquidity risk, derivatives risk, concentration risk and management risk

• The investor is urged to view the Key Investor Information Document and the fund prospectus for a detailed view of the risks to which the fund is exposed.

| Fund name | Evli Nordic Target Maturity Fund 2025 |

| Target instrument |

Nordic corporate bonds |

| Target return |

3% p.a. net of fees |

| Benchmark | None, absolute return target |

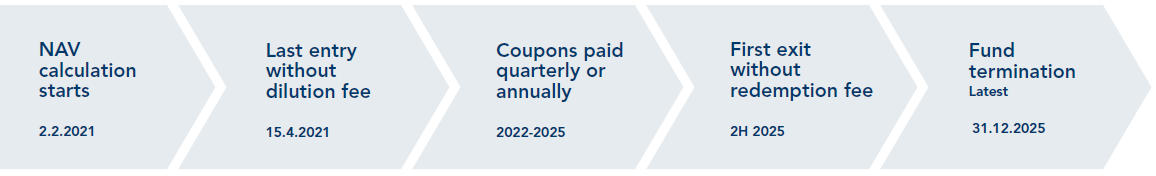

| Inception date | 2.2.2021 |

| Strategy maturity date | By 31.12.2025 |

| Recommended investment period | Until maturity |

| Management Company | Evli Fund Management Company Ltd |

| Custodian | Skandinaviska Enskilda Banken AB (publ) Helsinki branch |

| Structure | UCITS |

| Subscriptions and redemptions | Daily at Net Asset Value (NAV) |

| Subscription cut-off | On NAV day at 13:00 CET |

| Redemption cut-off | On NAV day at 13:00 CET |

EN Key Investor Information Document A-series

EN Key Investor Information Document B-series

EN Key Investor Information Document CA-series

EN Key Investor Information Document CB-series

EN Key Investor Information Document IA-series

EN Key Investor Information Document IB-series

EN Key Investor Information Document QA-series

EN Key Investor Information Document QIA-series

DE Wesentliche Anlegerinformationen A-series

DE Wesentliche Anlegerinformationen QA-series

ES Datos fundamentales para el inversor A-series

ES Datos fundamentales para el inversor B-series

ES Datos fundamentales para el inversor CA-series

ES Datos fundamentales para el inversor CB-series

ES Datos fundamentales para el inversor IA-series

ES Datos fundamentales para el inversor IB-series

ES Datos fundamentales para el inversor QA-series

ES Datos fundamentales para el inversor QIA-series

FR Informations clés pour l'investisseur B-series

FR Informations clés pour l'investisseur CB-series

FR Informations clés pour l'investisseur IB-series

IT Documento contenente le informazioni chiave per gli investitori IB-series

This material is intended as general information to the recipient. Nothing contained on this site constitutes investment advice, nor is it to be relied on, in an investment decision. The information

is product-related information only, and it is not to be regarded as an investment recommendation. Evli recommends that you read the relevant fund prospectus and brochure(s) and contact a

professional advisor in order to obtain relevant and specific personal advice, before making any investment decisions. No representation is made that the estimates, data or information herein is

complete, and the information can be subject to change without notice.

Past performance is not a guarantee for future results. Investments in funds can increase as well as decrease in value because of market fluctuations, the fund’s risk profile or costs related to

subscription, redemption, management fees etc., and the investor may lose the full amount invested.

Fund rules, Key Investor Information Document, brochures and other information material are available at www.evli.com/greenbond

Source and Copyright: Citywire. Juhamatti has been awarded the Eurostars award by Citywire for his rolling 3 year risk-adjusted performance, for the period 31/01/2016-31/01/2019.

Citywire information is proprietary and confidential to Citywire Financial Publishers Ltd (“Citywire”), may not be copied and Citywire excludes any liability arising out its use.

Morningstar Awards 2020 (c). Morningstar, Inc. All Rights Reserved. Morningstar has awarded Evli as the Best Fund House 2020 in Sweden.

From Lipper Fund Awards from Refinitiv, ©2020 Refinitiv. All rights reserved. Used under license.

As the value of mutual funds may rise or fall, it is not certain that you will always get back the invested assets. Past performance is not a guarantee of future returns.

×Evli Global Bond Fund will be merged on April 15, 2024. Read more.

×