It’s that time of the year that central bankers make their annual pilgrimage to Jackson Hole to discuss the economic state of the world.

Jackson Hole is about pondering the big picture

In 2013 the theme of the symposium concerned the effects of unconventional monetary policy, such as quantitative easing, on the real economy. This topic is as relevant now as it was then. Economic policymakers long for the good old days of conventional monetary policy. Policy lags were long and variable, but at least they were known.

Markets are myopic as usual. The focus is on hints as to when and how central banks unwind their QE programs. Mario Draghi’s speech will be perused for hints concerning the ECB’s September meeting and its announcement of a QE taper.

In 2014 and 2015 the topics were the labour market and inflation respectively. Unemployment rates flirt with historical lows in the US, UK and Germany, but price pressures remain non-existent. The relationship between unemployment and inflation known as the Phillips curve has historically been unstable, but now it just seems dead. We are potentially trudging along the most nonlinear Phillips curve in history.

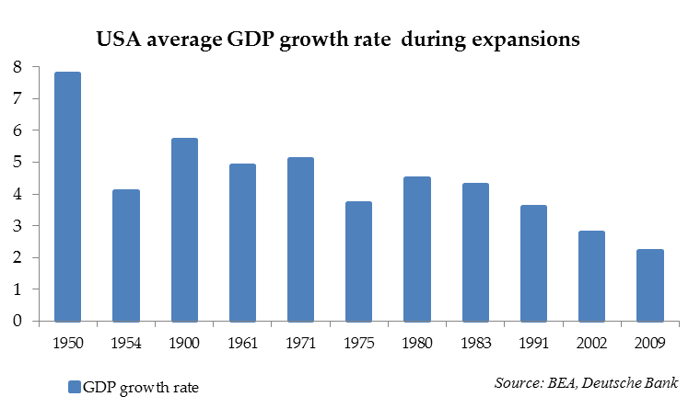

This year’s topic is ”Fostering a Dynamic Global Economy.” Figure 1 depicts the average annual GDP growth rate of every US economic expansion since the Second World War. Clearly there is a definite lack of dynamism in the economy. The economic expansion that began in 2009 is the slowest post WW2 expansion to date.

The chart also makes it evident that there has been a secular fall in economic growth rates. Almost every expansion has been slower than the one preceding it. The average annualized GDP growth rate in the expansion that begun in 2009 is 2.2 %, whilst in 2002 the corresponding figure was 2.8 %, in 1991 it was 3.6 %, in 1983 it was 4.3 % and in 1980 it was 4.5 %. The growth rates continue to increase as we approach the WW2.

Demographics, productivity and globalization dampen long run economic growth

The secular fall in economic growth rates is not specific to the US. Rather it is a near universal phenomenon in rich economies. The primary reason is ageing demographics. The fall in population growth rates results in falling labour force growth rates, which in turn reduces economic growth rates. Demographics also takes an indirect toll on growth. Statistically older workers are less productive than younger workers. In addition an ageing population implies a heavier burden on the working age population as the relative number of pensioners rises.

The second secular reason for slowing economic growth rates is the fall in productivity growth rates. Except for an internet induced productivity leap at the turn of the millennium, productivity growth has steadily weakened in the post Second World War era.

Productivity is driven primarily by technological progress. Pessimists think that productivity growth is doomed by the fact that technological growth has been beset by diminishing returns. Luckily historically technological doomsayers have been humbled. Another reason for optimism is measurement error. Productivity measurement is anything but a straightforward exercise.

The third secular factor is globalization. We may have reaped the bulk of the benefits stemming from globalization to a large extent. The entry of China and the former Soviet republics into the global marketplace gave a huge boost to global value chains and kept inflation at bay. Perhaps other developing economies such as India might not serve a similar role in the future.

The Effects of Monetary Policy in the Long Run

Demographics, productivity and globalisation are long term factors that are independent of the business cycle. The goal of monetary policy is about smoothing the short run business cycle. It cannot compensate for secular decline. However, reckless monetary policy may hurt long term economic growth. An extreme example is central bank induced hyperinflation.

In the best case monetary policy moderates economic fluctuations and doesn’t hurt long run economic growth. Central banks have managed to do so in the Jackson Hole era. One shouldn’t ask for more. Monetary policy is not a panacea for structural issues as a scholar of economics, such as Janet Yellen, might tell you.