Investors are scratching their heads wondering where they will get the returns in the fixed income markets. Is there any asset class that can provide the needed returns for investors, or is all hope lost? We believe that the European High Yield segment is still a decent investment and, in many cases, the only game in town.

On the quest for yield

The ECB’s purchases of corporate bonds have changed the dynamics of the credit market, and not for the better. Investors this year have been buying Investment Grade rated credits that are on the central banks’ list, not necessarily because they offer great value, but because they expect the ECB buy them at a higher price. The roll-down continues to be extremely strong as short term rates are firmly negative.

We believe that listed corporate credit still looks attractive at these spreads and particularly the spreads in European High Yield bonds. The low yields are certainly a problem for corporate bonds as well, but the spread more than compensates for the additional risk taken when moving into High Yield. Presently, the spread of B-rated corporates has been tighter for about 30 percent of the time (data from 1999–2016). With the huge search for yield and good corporate fundamentals, we expect the spread to tighten through the 25 percentile during the next year. That would be an additional tightening of 50 bps. The very tightest level of the market since 1999, ie. historical spreads have only been below this level 10 percent of the time, is still far away. We are almost a 150 bps away.

Source: Bank of America, Evli

What are the risks?

What has been striking during this credit cycle in Europe is how little additional debt corporates have taken in this credit cycle. Historically, this point in the cycle is the time when corporates have made huge investments, bought a competitor or paid a hefty dividend. All those strategic decisions that a couple a years later usually look less smart. However, this time round we have seen very little of this. Instead, corporate leverage in Europe has been declining and especially in High Yield most new debt issuance has been used for refinancing, not expansion.

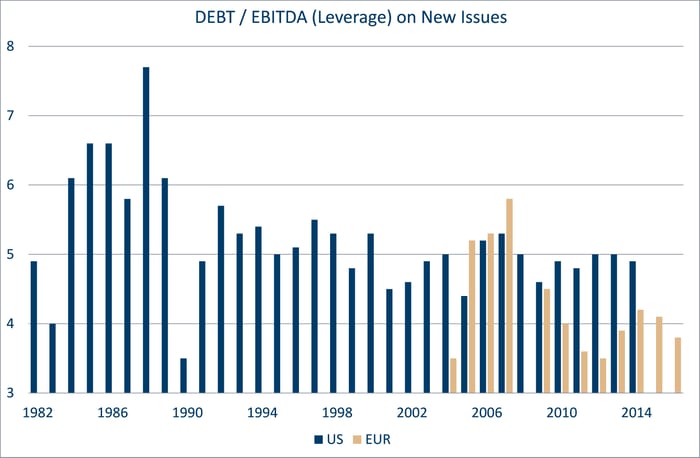

Credit is an asset class that usually outperforms most of the time, but when it underperforms, it does so massively. By not being invested in times of underperformance can materially increase the return over the cycle. All credit cycles eventually end, and in determining when this will happen we use the leverage on new issues as the main component of analysis.

JP Morgan’s data shows that We are still clearly below 4x Net Debt / EBITDA in Europe for new issue leverage during this year. Credit Suisse’s data for US High Yield issuers shows the present leverage in Europe is at the same level as the lowest leverage in US High Yield new issues since 1982. Combined with record low coupons on the debt, it is our opinion that the default rates in Europe will be very modest in the years to come. An increase in new issue leverage usually leads to a wider spread in 12–18 months‘ time after the leverage picks up.

Source: Credit Suisse, JP Morgan, Evli

European High Yield to continue performing

After a five-year period where the European High Yield market has had an annual return of around 10 percent it is clear that the best times are behind us. We believe that investors can achieve a decent return during the next three years. By decent we mean a return that is close to the yield to maturity of the market (5%). Historically this is clearly not great, but compared to all other euro fixed income markets it looks attractive. For people looking for an absolute return, the case is less compelling, but even here we believe it makes sense to buy High Yield.