In April, the Evli Emerging Frontier team met 134 companies from 24 countries as part of our 11 Sectors in 11 Months project, this time focusing on the Extractives & Minerals Processing sector.

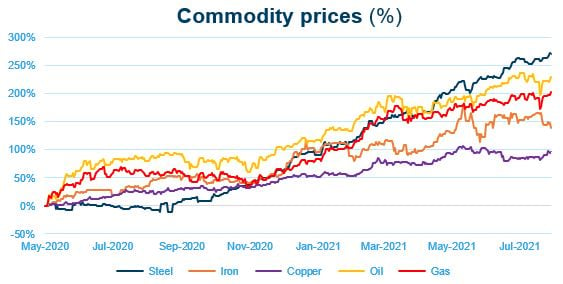

In this series of blog posts, we dive into the "11 Sectors in 11 Months" project by the Evli Emerging Frontier Fund team. The Evli Emerging Frontier Fund invests in cheap, growing, quality companies with sustainable ESG practices.In almost every meeting we learned that the current global supply of commodities is extremely short due to the Covid lockdown-related supply chain disruptions. At the same time, the massive economic stimulus that followed the Covid crisis in order to revive growth catalyzed building and manufacturing activity. As a result of the roaring demand and constrained supply, the prices of raw materials such as copper, steel, and lumber have been skyrocketing, benefiting emerging markets’ commodities producers. Several CEOs we spoke with believe we are at the beginning of a new commodities supercycle. This validates the forecast we made in our earlier blog post, The case for emerging markets, in which we discussed how the recovery of the commodities supercycle can be one of the main drivers of EM outperformance over the next several years.

Supply chain disruptions and massive economic stimulus push commodity prices to record highs

Prima Coal: What’s in a name?

This month, we found a company which strongly benefits from this boom in commodities: a $200m Indonesian firm named “Kapuas Prima Coal”. Due to higher commodity prices, the company expects higher earnings this year, and is currently building two new production facilities to accommodate fast-growing demand. This firm is a great example of an undiscovered business which has been completely overlooked by investors due to market inefficiencies. The inefficiency in this case is very simple: it’s in the company’s name. Despite the moniker that makes it look like a coal mining operation, it is in fact a zinc processing business with 0% exposure to coal. The company’s management said that institutional investors wouldn’t even talk to them because of the misleading name. To our recommendation of a name change, the CEO said it would be difficult to change the name on all their licenses, and so for now they try to explain their true essence through a simple but telling ticker: ZINC.

Meeting with a $200m Indonesian zinc processing firm

Undiscovered steel producer benefiting from extraordinary demand

We also invested in a $70m Malaysian steel producer. The market forgot about this company as well: it was unprofitable for the last few years, and the CEO hadn’t spoken to investors – instead, he was busy upgrading the plant with a new cost-saving technology and strengthening the firm’s balance sheet. The timing could not be better to have finished the turnaround now: due to the global supply chain constraints and construction boom, steel prices have been reaching new highs daily, and demand has been extraordinary. Yet while most steel companies’ stock prices have grown rapidly this year, this company’s stock has remained flat.

Meeting with a $70m Malaysian steel producer

Learn more about our Evli Emerging Frontier Fund

Our recent blogs in the "11 Sectors in 11 Months" series

A month focused on technology: Chip shortage drives demand and earnings during the pandemic

A month focused on consumer goods: Pandemic boosts Indonesian furniture and Colombian windows